NetSpend 2014 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2014 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

joint bookrunners (the “Existing Credit Agreement”). The Existing Credit Agreement provides for a $350.0 million

five-year unsecured revolving credit facility (which may be increased by up to an additional $350.0 million under

certain circumstances) and includes a $50.0 million subfacility for the issuance of standby letters of credit and a

$50.0 million subfacility for swingline loans. The Existing Credit Agreement also provides for a $150 million five-

year unsecured term loan, which was fully funded on the closing of the Existing Credit Agreement. As of

December 31, 2014, the outstanding balance on the Existing Credit Agreement was $131.3 million.

In April 2013, the Company entered into the First Amendment to the Existing Credit Agreement (the “Revolver”)

in order to conform certain provisions of the Existing Credit Agreement to the Credit Agreement for the Term

Loan. On July 1, 2013, an additional $100.0 million was used as funding in the NetSpend Merger. As of

December 31, 2014, there was no outstanding balance on the Revolver.

The Credit Agreement for the aforementioned loan provided for a $168.0 million unsecured five year term loan

to the Company and a $252.0 million five year unsecured revolving credit facility. The principal balance of loans

outstanding under the credit facility bears interest at a rate of LIBOR plus an applicable margin of 0.60%. The

applicable margin could vary within a range from 0.27% to 0.725% depending on changes in the Company’s

corporate credit rating. Interest was paid on the last date of each interest period; however, if the period

exceeded three months, interest was paid every three months after the beginning of such interest period. In

addition, the Company paid each lender a fee in respect of the amount of such lender’s commitment under the

revolving credit facility (regardless of usage), ranging from 0.08% to 0.15% (currently 0.10%) depending on the

Company’s corporate credit rating.

The Company was not required to make any scheduled principal payments other than payment of the entire

outstanding balance on December 21, 2012. The Company was able to prepay the revolving credit facility and

the term loan in whole or in part at any time without premium or penalty, subject to reimbursement of the

lenders’ customary breakage and redeployment costs in the case of prepayment of LIBOR borrowings. The

Credit Agreement included covenants requiring the Company to maintain certain minimum financial ratios. The

Company did not use the revolving credit facility in 2014.

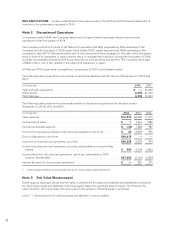

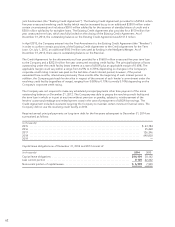

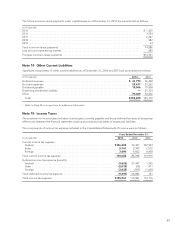

Required annual principal payments on long-term debt for the five years subsequent to December 31, 2014 are

summarized as follows:

(in thousands)

2015 ................................................................................. $ 43,784

2016 ................................................................................. 35,468

2017 ................................................................................. 126,396

2018 ................................................................................. 690,000

2019 ................................................................................. —

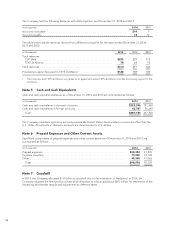

Capital lease obligations as of December 31, 2014 and 2013 consist of:

(in thousands) 2014 2013

Capital lease obligations ......................................................... $14,101 30,162

Less current portion ............................................................. 7,127 22,662

Noncurrent portion of capital leases ................................................ $ 6,974 7,500

62