NetSpend 2014 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2014 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

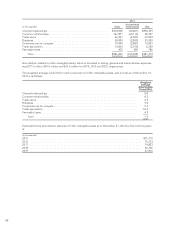

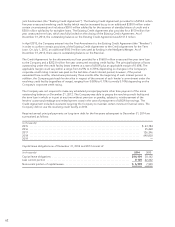

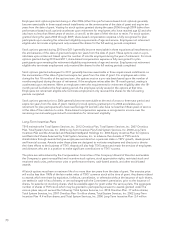

A reconciliation of the beginning and ending amount of unrecognized tax liabilities is as follows 1:

(in millions) Year Ended

December 31, 2014

Beginning balance .............................................................. $2.7

Current activity:

Additions based on tax positions related to current year ............................. 0.9

Additions for tax positions of prior years .......................................... 3.5

Reductions for tax positions of prior years ......................................... (0.4)

Net, current activity ......................................................... 4.0

Ending balance ................................................................. $6.7

1 Unrecognized state tax liabilities are not adjusted for the federal tax impact

TSYS recognizes potential interest and penalties related to the underpayment of income taxes as income tax

expense in the Consolidated Statements of Income. Gross accrued interest and penalties on unrecognized tax

benefits totaled $0.3 million and $0.3 million as of December 31, 2014 and December 31, 2013, respectively. The

total amounts of unrecognized income tax benefits as of December 31, 2014 and December 31, 2013 that, if

recognized, would affect the effective tax rates are $6.5 million and $2.8 million (net of the federal benefit on

state tax issues), respectively, which includes interest and penalties of $0.2 million and $0.2 million, respectively.

Note 16 Commitments and Contingencies

LEASE COMMITMENTS: TSYS is obligated under noncancelable operating leases for computer equipment

and facilities.

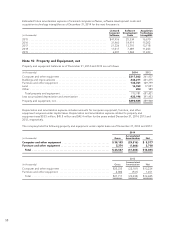

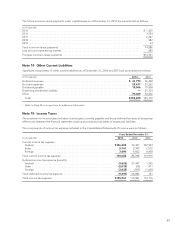

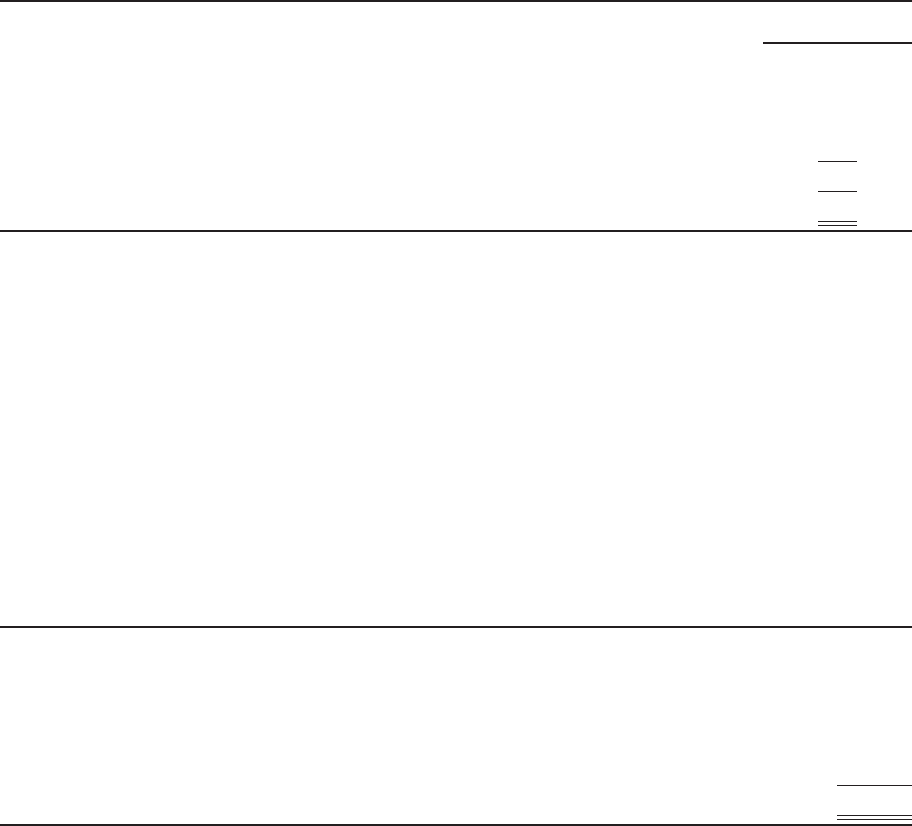

The future minimum lease payments under noncancelable operating leases with remaining terms greater than

one year for the next five years and thereafter and in the aggregate as of December 31, 2014, are as follows:

(in thousands)

2015 ................................................................................. $118,321

2016 ................................................................................. 121,745

2017 ................................................................................. 62,741

2018 ................................................................................. 27,184

2019 ................................................................................. 22,693

Thereafter ............................................................................. 30,088

Total future minimum lease payments ...................................................... $382,772

The majority of computer equipment lease commitments come with a renewal option or an option to terminate

the lease. These lease commitments may be replaced with new leases which allow the Company to continually

update its computer equipment. Total rental expense under all operating leases in 2014, 2013 and 2012 was

$105.2 million, $93.4 million and $95.2 million, respectively.

CONTRACTUAL COMMITMENTS: In the normal course of its business, the Company maintains long-term

processing contracts with its clients. These processing contracts contain commitments, including, but not limited

to, minimum standards and time frames against which the Company’s performance is measured. In the event the

Company does not meet its contractual commitments with its clients, the Company may incur penalties and

certain clients may have the right to terminate their contracts with the Company. The Company does not believe

that it will fail to meet its contractual commitments to an extent that will result in a material adverse effect on its

financial position, results of operations or cash flows.

66