Lexmark 2011 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2011 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

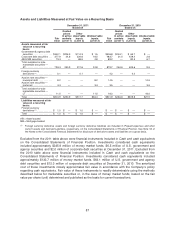

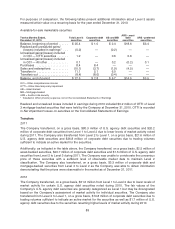

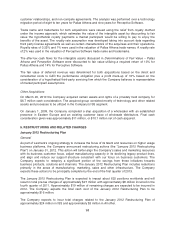

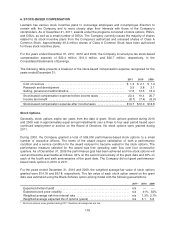

The following table summarizes the assets acquired and liabilities assumed as of the acquisition date.

Trade receivables .............................................................. $ 2.1

Other assets .................................................................. 0.3

Property, plant and equipment .................................................... 0.2

Identifiable intangible assets ..................................................... 20.7

Accounts payable .............................................................. (1.9)

Short-term borrowings .......................................................... (5.0)

Deferred revenue .............................................................. (0.2)

Other liabilities ................................................................. (1.6)

Long-term debt ................................................................ (2.1)

Deferred tax liability, net (*) ...................................................... (4.6)

Total identifiable net assets ...................................................... 7.9

Goodwill ...................................................................... 33.5

Total purchase price ............................................................ $41.4

* Deferred tax liability, net primarily relates to purchased identifiable intangible assets and is shown net of deferred tax assets.

A change to the acquisition date value of the identifiable net assets during the measurement period (up

to one year from the acquisition date) will affect the amount of the purchase price allocated to goodwill.

The fair value of trade receivables approximated the carrying value of $2.1 million. The gross amount

due from customers was $2.1 million, all of which the Company expects to collect.

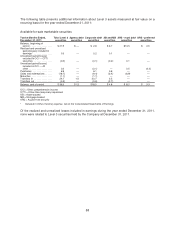

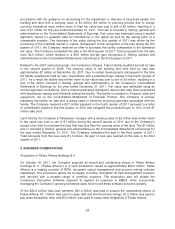

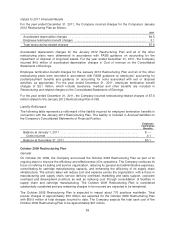

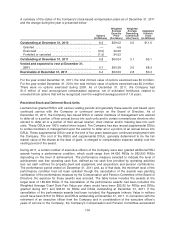

The following table summarizes the identifiable intangible assets recognized in the acquisition of Pallas

Athena. The intangible assets subject to amortization are being amortized on a straight-line basis over

their estimated useful lives as of the acquisition date, according to the following schedule.

Fair Value

Recognized

Weighted-Average

Useful Life

Intangible assets subject to amortization:

Trade names ............................................... $ 2.6 10.0 years

Customer relationships ....................................... 7.8 5.0years

Non-compete agreements .................................... 0.1 3.0years

Purchased technology ....................................... 8.9 5.0years

Total ...................................................... 19.4 5.7 years

Intangible assets not subject to amortization:

In-process technology ........................................ 1.3 *

Total identifiable intangible assets .............................. $20.7

* Amortization to begin upon completion of the project

The Company assumed $5.0 million of short-term borrowings and $2.1 million of long-term debt in the

acquisition. These amounts were repaid shortly after the acquisition and are included in Repayment of

assumed debt in the financing section of the Company’s Consolidated Statements of Cash Flows for

2011. There was no gain or loss recognized on the extinguishment of the debt.

Goodwill of $33.5 million arising from the acquisition was assigned to the Perceptive Software

reportable segment and consisted largely of projected future revenue and profit growth, including

benefits from Lexmark’s international structure and sales channels and entity-specific synergies

expected from combining Pallas Athena with Lexmark’s business. None of the goodwill recognized is

expected to be deductible for income tax purposes.

The acquisition of Pallas Athena is included in Purchases of businesses net of cash acquired in the

investing section of the Consolidated Statements of Cash Flows for 2011 in the amount of

94