Lexmark 2011 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2011 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Part II

Item 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Lexmark’s Class A Common Stock is traded on the New York Stock Exchange under the symbol

“LXK.” As of February 17, 2012, there were 2,596 holders of record of the Class A Common Stock and

there were no holders of record of the Class B Common Stock. Information regarding the market prices

of the Company’s Class A Common Stock appears in Part II, Item 8, Note 22 of the Notes to

Consolidated Financial Statements.

Dividend Policy

On October 27, 2011, the Company’s Board of Directors declared its first dividend of $0.25 per share

on outstanding Class A Common Stock which was paid on November 30, 2011, to shareholders of

record as of the close of business on November 15, 2011. The quarterly rate represents an annualized

dividend of $1.00 per share.

On February 23, 2012, subsequent to the date of the financial statements, the Company’s Board of

Directors declared a quarterly dividend of $0.25 per share on outstanding Class A Common Stock. The

cash dividend will be paid on March 16, 2012, to shareholders of record as of the close of business on

March 5, 2012.

Going forward, the Company plans to return more than 50 percent of free cash flow (after operating

and capital investment needs) to its shareholders through dividends and share repurchases. The

Company anticipates paying dividends quarterly, though future declarations of dividends are subject to

Board of Directors’ approval and may be adjusted as business needs or market conditions change.

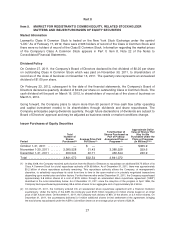

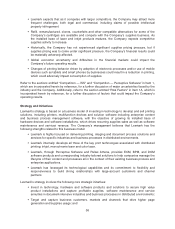

Issuer Purchases of Equity Securities

Period

Total

Number of

Shares

Purchased (2)

Average Price Paid

Per Share (2)

Total Number of

Shares Purchased as

Part of Publicly

Announced Plans or

Programs (2)

Approximate Dollar

Value of Shares That

May Yet Be

Purchased Under the

Plans or Programs

(In Millions) (1)(2)

October 1-31, 2011 ........ — $ — — $365.9

November 1-30, 2011 ...... 3,380,528 31.43 3,380,528 259.6

December 1-31, 2011 ...... 460,544 40.71 460,544 240.9

Total .................... 3,841,072 $32.54 3,841,072

(1) In May 2008, the Company received authorization from the Board of Directors to repurchase an additional $0.75 billion of its

Class A Common Stock for a total repurchase authority of $4.65 billion. As of December 31, 2011, there was approximately

$0.2 billion of share repurchase authority remaining. This repurchase authority allows the Company, at management’s

discretion, to selectively repurchase its stock from time to time in the open market or in privately negotiated transactions

depending upon market price and other factors. For the three months ended December 31, 2011, the Company repurchased

approximately 3.8 million shares at a cost of $125 million through an accelerated share repurchase agreement (“ASR”)

described in the note immediately below. As of December 31, 2011 since the inception of the program in April 1996, the

Company had repurchased approximately 99.6 million shares for an aggregate cost of approximately $4.4 billion.

(2) On October 27, 2011, the Company entered into an accelerated share repurchase agreement with a financial institution

counterparty. Under the terms of the ASR, the Company paid $125 million targeting 4.0 million shares based on an initial

price of $31.43 per share. On November 1, 2011, the Company took delivery of 85% of the shares, or 3.4 million shares. On

December 21, 2011, the counterparty delivered 0.4 million additional shares in final settlement of the agreement, bringing

the total shares repurchased under the ASR to 3.8 million shares at an average price per share of $32.54.

27