Lexmark 2011 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2011 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

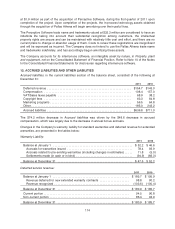

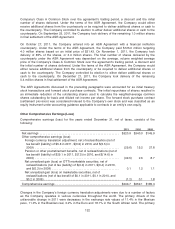

at $1.9 million as part of the acquisition of Perceptive Software, during the first quarter of 2011 upon

completion of the project. Upon completion of the projects, the in-process technology assets obtained

through the acquisition of Pallas Athena will begin amortizing over their useful lives.

The Perceptive Software trade name and trademarks valued at $32.3 million are considered to have an

indefinite life taking into account their substantial recognition among customers, the intellectual

property rights are secure and can be maintained with relatively little cost and effort, and there are no

current plans to change or abandon usage of them. Costs to renew these registrations are insignificant

and will be expensed as incurred. The Company does not intend to use the Pallas Athena trade name

and trademarks indefinitely, and has accordingly begun amortizing these assets.

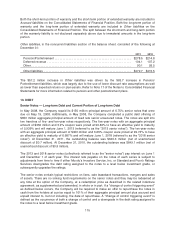

The Company accounts for its internal-use software, an intangible asset by nature, in Property, plant

and equipment, net on the Consolidated Statement of Financial Position. Refer to Note 10 of the Notes

to the Consolidated Financial Statements for disclosures regarding internal-use software.

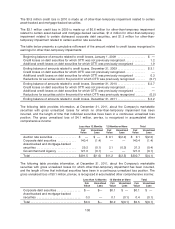

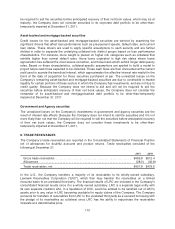

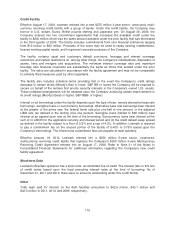

12. ACCRUED LIABILITIES AND OTHER LIABILITIES

Accrued liabilities, in the current liabilities section of the balance sheet, consisted of the following at

December 31:

2011 2010

Deferred revenue ...................................................... $154.7 $143.0

Compensation ........................................................ 108.4 157.0

VAT/Sales taxes payable ............................................... 68.9 38.2

Copyright fees ........................................................ 63.3 64.8

Marketing programs .................................................... 56.5 64.8

Other ................................................................ 185.0 243.2

Accrued liabilities ...................................................... $636.8 $711.0

The $74.2 million decrease in Accrued liabilities was driven by the $48.6 decrease in accrued

compensation, which was largely due to the decrease in annual bonus accruals.

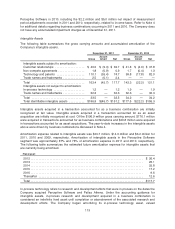

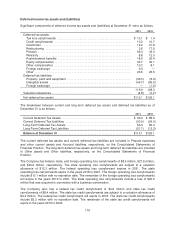

Changes in the Company’s warranty liability for standard warranties and deferred revenue for extended

warranties, are presented in the tables below:

Warranty Liability:

2011 2010

Balance at January 1 ................................................... $52.2 $ 46.6

Accruals for warranties issued .......................................... 78.4 93.9

Accruals related to pre-existing warranties (including changes in estimates) ..... 11.8 (5.0)

Settlements made (in cash or in kind) .................................... (94.9) (83.3)

Balance at December 31 ................................................ $47.5 $ 52.2

Deferred service revenue:

2011 2010

Balance at January 1 ................................................. $185.7 $ 195.9

Revenue deferred for new extended warranty contracts ................... 98.8 90.2

Revenue recognized ................................................ (103.6) (100.4)

Balance at December 31 .............................................. $180.9 $ 185.7

Current portion ....................................................... 94.5 90.8

Non-current portion ................................................... 86.4 94.9

Balance at December 31 .............................................. $180.9 $ 185.7

114