Lexmark 2011 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2011 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164

|

|

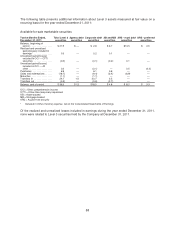

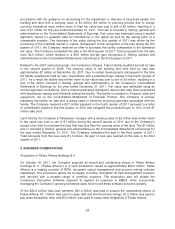

The following table presents additional information about Level 3 assets measured at fair value on a

recurring basis for the year ended December 31, 2011:

Available-for-sale marketable securities

Twelve Months Ended,

December 31, 2011

Total Level 3

securities

Agency debt

securities

Corporate debt

securities

AB and MB

securities

ARS - muni debt

securities

ARS - preferred

securities

Balance, beginning of

period .................. $27.5 $ — $ 2.8 $ 6.7 $14.5 $ 3.5

Realized and unrealized

gains/(losses) included in

earnings* ............... 0.3 — 0.2 0.1 — —

Unrealized gains/(losses)

included in OCI — OTTI

securities ............... (0.2) — (0.1) (0.2) 0.1 —

Unrealized gains/(losses)

included in OCI — All

other ................... 0.2 — (0.1) — 0.5 (0.2)

Purchases ................ 6.9 — 6.1 0.8 — —

Sales and redemptions ...... (18.7) — (9.4) (2.4) (6.9) —

Maturities ................. (1.1) — (1.1) — — —

Transfers in ............... 24.7 1.5 20.7 2.5 — —

Transfers out .............. (3.3) — (0.6) (2.7) — —

Balance, end of period ...... $36.3 $1.5 $18.5 $ 4.8 $ 8.2 $ 3.3

OCI = Other comprehensive income

OTTI = Other-than-temporary impairment

AB = Asset-backed

MB = Mortgage-backed

ARS = Auction rate security

* Included in Other (income) expense, net on the Consolidated Statements of Earnings

Of the realized and unrealized losses included in earnings during the year ended December 31, 2011,

none were related to Level 3 securities held by the Company at December 31, 2011.

88