Lexmark 2011 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2011 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

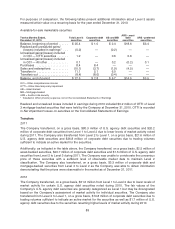

At December 31, 2011, the fair values of the Company’s five-year and ten-year notes were estimated

to be $364.1 million and $332.5 million, respectively, based on the prices the bonds have recently

traded in the market as well as the overall market conditions on the date of valuation. The $696.6

million total fair value of the debt is not recorded on the Company’s Consolidated Statements of

Financial Position and is therefore excluded from the 2011 fair value table above. The total carrying

value of the senior notes, net of $0.7 million discount, was $649.3 million on the December 31, 2011

Consolidated Statements of Financial Position.

At December 31, 2010, the fair values of the Company’s five-year and ten-year notes were estimated

to be $373.1 million and $320.7 million, respectively, based on the prices the bonds have recently

traded in the market as well as the overall market conditions on the date of valuation. The $693.8

million total fair value of the debt is not recorded on the Company’s Consolidated Statements of

Financial Position and is therefore excluded from the 2010 fair value table above. The total carrying

value of the senior notes, net of $0.9 million discount, was $649.1 million on the December 31, 2010

Consolidated Statements of Financial Position.

Refer to Note 13 of the Notes to the Consolidated Financial Statements for additional information

regarding the senior notes.

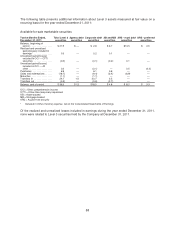

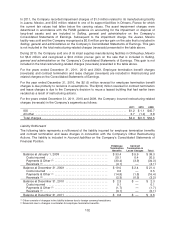

Plan assets

Plan assets must be measured at least annually in accordance with accounting guidance on

employers’ accounting for pensions and employers’ accounting for postretirement benefits other than

pensions. The fair value measurement guidance requires that the valuation of plan assets comply with

its definition of fair value, which is based on the notion of an exit price and the maximization of

observable inputs. The fair value measurement guidance does not apply to the calculation of pension

and postretirement obligations since the liabilities are not measured at fair value.

Refer to Note 17 of the Notes to the Consolidated Financial Statements for disclosures regarding the

fair value of plan assets.

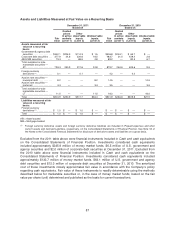

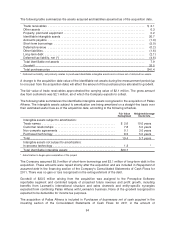

Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis Subsequent to Initial

Recognition

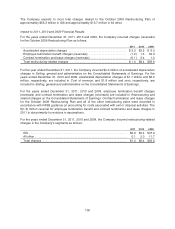

2011

Fair Value Measurements Using

Fair value

Quoted prices in

active markets

(Level 1)

Other observable

inputs

(Level 2)

Unobservable

inputs

(Level 3)

Total gains

(losses)

YTD 2011

Long-lived assets held for

sale* ..................... $6.8 $— $— $6.8 $(5.9)

$(5.9)

* Pertains to measurements during the year ended December 31, 2011.

Certain assets were sold and derecognized in the third quarter of 2011.

There were no material fair value adjustments to assets or liabilities measured at fair value on a

nonrecurring basis subsequent to initial recognition during 2010.

Long-lived assets held for sale

Related to the April 2009 restructuring plan, the Company’s inkjet cartridge manufacturing facility in

Juarez, Mexico qualified as held for sale in the first quarter of 2010. During the first quarter of 2011, in

92