Lexmark 2011 Annual Report Download - page 101

Download and view the complete annual report

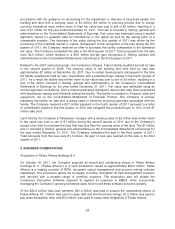

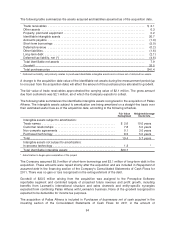

Please find page 101 of the 2011 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The trade names and trademarks are considered to have an indefinite life taking into account their

substantial recognition among customers, the intellectual property rights are secure and can be

maintained with relatively little cost and effort, and there are no current plans to change or abandon

usage of them. Declarations of use and renewals of registrations will take place as required.

The Company assumed $3.1 million of long term debt in the acquisition. The debt was repaid in the

second quarter of 2010 after the acquisition date and is included in Repayment of assumed debt in the

financing section of the Company’s Consolidated Statements of Cash Flows. There was no gain or loss

recognized on the early extinguishment of long term debt.

Other liabilities of $14.5 million assumed in the transaction were made up mostly of accrued expenses,

such as accrued payroll and related taxes, vacation, incentive compensation, and commissions.

Goodwill of $161.8 million, net of measurement period adjustments, arising from the acquisition

consisted largely of projected future revenue and profit growth, including benefits from Lexmark’s

international structure and sales channels, and the synergies expected from combining the businesses.

All of the goodwill was assigned to Perceptive Software, which remains a stand-alone business within

the Company for purposes of segment reporting. None of the goodwill recognized is expected to be

deductible for income tax purposes.

The acquisition of Perceptive Software is included in Purchases of businesses net of cash acquired in

the investing section of the Consolidated Statements of Cash Flows in the amount of $266.8 million,

which is the total purchase price of $280 million net of cash acquired of $13.2 million.

Acquisition-related costs in the amount of $5.8 million were charged directly to operations and were

included in Selling, general and administrative on the Consolidated Statements of Earnings.

Acquisition-related costs include legal, advisory, valuation, accounting, and other fees incurred to effect

the business combination.

Because Perceptive Software’s current levels of revenue and net earnings are not material to the

Company’s Consolidated Statements of Earnings, supplemental pro forma revenue and net earnings

disclosures have been omitted. Refer to Note 20 for Perceptive Software segment data.

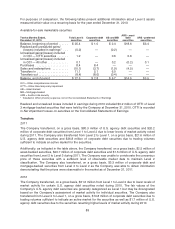

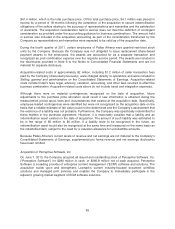

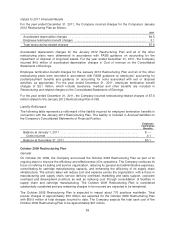

Determination of Fair Value — Pallas Athena and Perceptive Software

For both the Pallas Athena and Perceptive Software acquisitions, the total amount recognized for the

acquired identifiable net assets was driven by the fair values of intangible assets. Valuation techniques

and key inputs and assumptions used to value the most significant identifiable intangible assets are

discussed below.

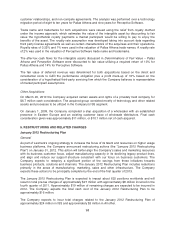

Customer relationships for both acquisitions were valued using the with and without method of the

income approach, which estimates the value of the intangible asset by quantifying the lost profits under

a hypothetical condition where the customer relationships no longer exist immediately following the

acquisition and must be re-created.

Purchased technology, or developed technology, was valued for both acquisitions using the excess

earnings method under the income approach, which estimates the value of the intangible asset by

calculating the present value of the incremental after-tax cash flows, or excess earnings, attributable

solely to the developed technology over the estimated period that it generates revenues. After-tax cash

flows were calculated by applying cost, expense, income tax, and contributory asset charge

assumptions to the estimated developed technology revenue streams. Contributory asset charges

included net working capital, net fixed assets, assembled workforce, trade name and trademarks,

97