Lexmark 2011 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2011 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

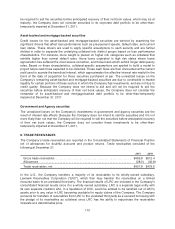

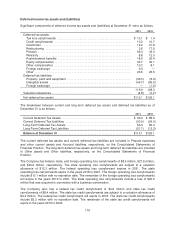

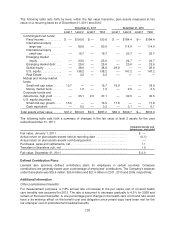

Deferred income tax assets and (liabilities)

Significant components of deferred income tax assets and (liabilities) at December 31 were as follows:

2011 2010

Deferred tax assets:

Tax loss carryforwards ............................................... $ 13.1 $ 1.4

Credit carryforwards ................................................. 10.2 10.7

Inventories ......................................................... 19.2 21.8

Restructuring ....................................................... 3.6 17.6

Pension ............................................................ 66.3 43.3

Warranty ........................................................... 8.8 12.3

Postretirement benefits ............................................... 18.0 20.4

Equity compensation ................................................. 32.7 32.1

Other compensation ................................................. 10.2 8.1

Foreign exchange ................................................... 0.4 —

Other .............................................................. 23.6 26.6

Deferred tax liabilities:

Property, plant and equipment ......................................... (39.5) (8.9)

Intangible assets .................................................... (46.7) (55.5)

Foreign exchange ................................................... — (1.6)

119.9 128.3

Valuation allowances ................................................... (4.8) (2.2)

Net deferred tax assets ................................................. $115.1 $126.1

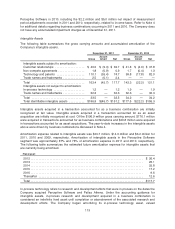

The breakdown between current and long-term deferred tax assets and deferred tax liabilities as of

December 31 is as follows:

2011 2010

Current Deferred Tax Assets ............................................ $ 93.4 $ 88.0

Current Deferred Tax Liabilities .......................................... (20.0) (29.0)

Long-Term Deferred Tax Assets ......................................... 63.4 80.4

Long-Term Deferred Tax Liabilities ....................................... (21.7) (13.3)

Balance at December 31 ............................................... $115.1 $126.1

The current deferred tax assets and current deferred tax liabilities are included in Prepaid expenses

and other current assets and Accrued liabilities, respectively, on the Consolidated Statements of

Financial Position. The long-term deferred tax assets and long-term deferred tax liabilities are included

in Other assets and Other liabilities, respectively, on the Consolidated Statements of Financial

Position.

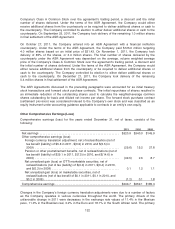

The Company has federal, state, and foreign operating loss carryforwards of $8.9 million, $27.6 million,

and $34.9 million, respectively. The state operating loss carryforwards are subject to a valuation

allowance of $12.3 million. The federal operating loss carryforward expires in 2031. The state

operating loss carryforwards expire in the years 2018 to 2021. The foreign operating loss carryforwards

include $10.1 million with no expiration date. The remainder of the foreign operating loss carryforwards

will expire in the years 2016 to 2031. The state operating loss carryforwards include a loss of $22.6

million that was acquired in connection with a business combination.

The Company also has a federal tax credit carryforward of $4.6 million and state tax credit

carryforwards of $8.4 million. The state tax credit carryforwards are subject to a valuation allowance of

$3.4 million. The federal tax credit carryforward will expire in 2018. The state tax credit carryforwards

include $5.2 million with no expiration date. The remainder of the state tax credit carryforwards will

expire in the years 2016 to 2024.

119