Lexmark 2011 Annual Report Download - page 95

Download and view the complete annual report

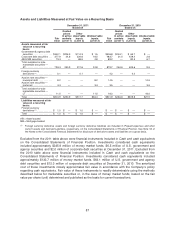

Please find page 95 of the 2011 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Asset-backed and mortgage-backed securities

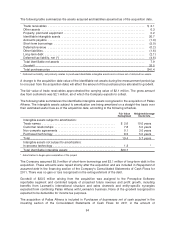

Securities in this group include asset-backed securities, U.S. agency mortgage-backed securities, and

other mortgage-backed securities. These securities generally have lower levels of trading activity than

government and agency debt securities and corporate debt securities and, therefore, their fair values

may be based on other inputs, such as spread data. The consensus price method is generally used to

determine the most appropriate price in the range provided. Fair value measurements of these

investments are most often categorized as Level 2; however, these securities are categorized as Level

3 when there is higher variability in the pricing data, a low number of pricing sources, or the Company

is otherwise unable to gather supporting information to conclude that the price can be transacted upon

in the market at the reporting date.

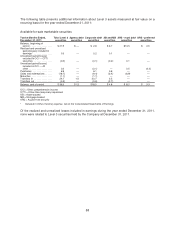

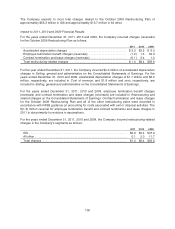

Auction rate securities

The Company’s auction rate securities for which recent auctions were unsuccessful are made up of

student loan revenue bonds valued at $2.7 million, municipal sewer and airport revenue bonds valued

at $5.5 million, and auction rate preferred stock valued at $3.3 million at December 31, 2011. The

Company’s auction rate securities for which recent auctions were unsuccessful were made up of

student loan revenue bonds valued at $9.0 million, municipal sewer and airport revenue bonds valued

at $5.5 million, and auction rate preferred stock valued at $3.5 million at December 31, 2010.

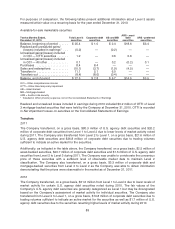

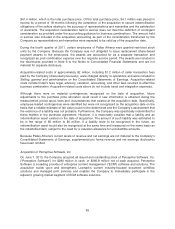

At December 31, 2011, the Company’s auction rate securities for which recent auctions were

unsuccessful were valued using a discounted cash flow model based on the characteristics of the

individual securities, which the Company believes yields the best estimate of fair value. The first step in

the valuation included a credit analysis of the security which considered various factors including the

credit quality of the issuer (and insurer if applicable), the instrument’s position within the capital

structure of the issuing authority, and the composition of the authority’s assets including the effect of

insurance and/or government guarantees. Next, the future cash flows of the instruments were

projected based on certain assumptions regarding the auction rate market significant to the valuation

including (1) the auction rate market will remain illiquid and auctions will continue to fail causing the

interest rate to be the maximum applicable rate and (2) the securities will not be redeemed. These

assumptions resulted in discounted cash flow analysis being performed through the legal maturities of

most of the securities, ranging from July 2032 through December 2037, or in the case of the auction

rate preferred stock, through the mandatory redemption date of December 2021. The projected cash

flows were then discounted using the applicable yield curve plus a 250 basis point liquidity premium

added to the applicable discount rate. Different assumptions were used for one of the Company’s

municipal bonds due to the distressed financial conditions of both the issuer and the insurer. The fair

value of this security was $2.4 million, and was primarily based on the expected recoveries that holders

could realize from bankruptcy proceedings after a likely work out period of 0.75 years.

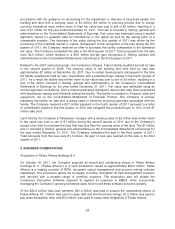

Derivatives

The Company employs a foreign currency risk management strategy that periodically utilizes derivative

instruments to protect its interests from unanticipated fluctuations in earnings and cash flows caused

by volatility in currency exchange rates. Fair values for the Company’s derivative financial instruments

are based on pricing models or formulas using current market data. Variables used in the calculations

include forward points and spot rates at the time of valuation. Because of the very short duration of the

Company’s transactional hedges there is minimal risk of nonperformance. At December 31, 2011 and

2010, all of the Company’s forward exchange contracts were designated as Level 2 measurements in

the fair value hierarchy. Refer to Note 18 of the Notes to the Consolidated Financial Statements for

more information regarding the Company’s derivatives.

Senior notes

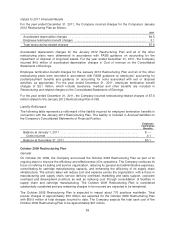

In May 2008, the Company issued $350 million of five-year fixed rate senior unsecured notes and

$300 million of ten-year fixed rate senior unsecured notes.

91