Lexmark 2011 Annual Report Download - page 90

Download and view the complete annual report

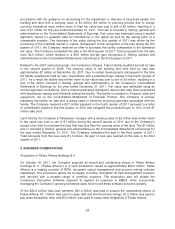

Please find page 90 of the 2011 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and instruments and transactions subject to an agreement similar to a master netting arrangement.

ASU 2011-11 does not change the existing offsetting eligibility criteria or the permitted balance sheet

presentation for those instruments that meet the eligibility criteria. The amendments will be effective for

the Company in the first quarter of fiscal 2013 and must be applied retrospectively, requiring

disclosures for all comparative periods presented.

The FASB and SEC issued other guidance during 2011, not discussed above, that related to technical

changes of existing guidance or new guidance that is not applicable to the Company’s current financial

statements and disclosures.

Reclassifications:

Certain prior year amounts have been reclassified, if applicable, to conform to the current presentation.

Refer to Note 4 of the Notes to Consolidated Financial Statements for information regarding the first

quarter 2011 measurement period adjustment applied retrospectively to the Consolidated Statements

of Financial Position related to the acquisition of Perceptive Software that occurred in the second

quarter of 2010.

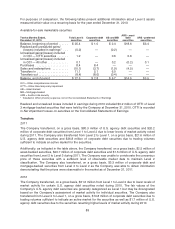

3. FAIR VALUE

General

The accounting guidance for fair value measurements defines fair value, establishes a framework for

measuring fair value in accordance with U.S. generally accepted accounting principles (“GAAP”), and

requires disclosures about fair value measurements. The guidance defines fair value as the price that

would be received to sell an asset or paid to transfer a liability in an orderly transaction between market

participants at the measurement date. As part of the framework for measuring fair value, the guidance

establishes a hierarchy of inputs to valuation techniques used in measuring fair value that maximizes

the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most

observable inputs be used when available.

Fair Value Hierarchy

The three levels of the fair value hierarchy are:

• Level 1 — Quoted prices (unadjusted) in active markets for identical, unrestricted assets or

liabilities that the Company has the ability to access at the measurement date;

• Level 2 — Inputs other than quoted prices included in Level 1 that are observable for the

asset or liability, either directly or indirectly; and

• Level 3 — Unobservable inputs used in valuations in which there is little market activity for the

asset or liability at the measurement date.

Fair value measurements of assets and liabilities are assigned a level within the fair value hierarchy

based on the lowest level of any input that is significant to the fair value measurement in its entirety.

86