Lexmark 2011 Annual Report Download - page 67

Download and view the complete annual report

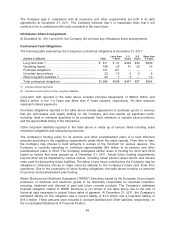

Please find page 67 of the 2011 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.period. As of December 31, 2011, there was approximately $241 million of remaining share repurchase

authority from the Board of Directors. This repurchase authority allows the Company, at management’s

discretion, to selectively repurchase its stock from time to time in the open market or in privately negotiated

transactions depending upon market price and other factors. Refer to Part II, Item 8, Note 15 of the Notes

to Consolidated Financial Statements for additional information regarding share repurchases. The

Company did not repurchase any shares of its Class A Common Stock in 2010 or 2009.

On October 27, 2011, the Company’s board declared its first dividend of $0.25 per share on

outstanding Class A common stock which was paid on November 30, 2011, to shareholders of record

as of the close of business on November 15, 2011. The quarterly rate represents an annualized

dividend of $1.00 per share.

On February 23, 2012, subsequent to the date of the financial statements, the Company’s Board of

Directors declared a cash dividend of $0.25 per share. The cash dividend will be paid on March 16,

2012, to shareholders of record as of the close of business on March 5, 2012. Future declarations of

quarterly dividends are subject to approval by the Board of Directors and may be adjusted as business

needs or market conditions change.

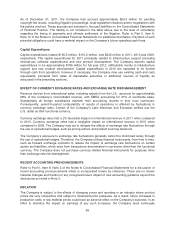

Senior Notes — Long-term Debt

In May 2008, the Company repaid its $150 million principal amount of 6.75% senior notes that were

due on May 15, 2008. Subsequently, in May 2008, the Company completed a public debt offering of

$650 million aggregate principal amount of fixed rate senior unsecured notes. The notes are split into

two tranches of five- and ten-year notes respectively. The five-year notes with an aggregate principal

amount of $350 million and 5.9% coupon were priced at 99.83% to have an effective yield to maturity

of 5.939% and will mature June 1, 2013 (referred to as the “2013 senior notes”). The ten-year notes

with an aggregate principal amount of $300 million and 6.65% coupon were priced at 99.73% to have

an effective yield to maturity of 6.687% and will mature June 1, 2018 (referred to as the “2018 senior

notes”). At December 31, 2011 and December 31, 2010, the outstanding balance of senior note debt

was $649.3 million and $649.1 million, respectively, net of discount.

The 2013 and 2018 senior notes (collectively referred to as the “senior notes”) pay interest on June 1

and December 1 of each year. The interest rate payable on the notes of each series is subject to

adjustments from time to time if either Moody’s Investors Service, Inc. or Standard and Poor’s Ratings

Services downgrades the debt rating assigned to the notes to a level below investment grade, or

subsequently upgrades the ratings.

The senior notes contain typical restrictions on liens, sale leaseback transactions, mergers and sales

of assets. There are no sinking fund requirements on the senior notes and they may be redeemed at

any time at the option of the Company, at a redemption price as described in the related indenture

agreement, as supplemented and amended, in whole or in part. If a “change of control triggering event”

as defined below occurs, the Company will be required to make an offer to repurchase the notes in

cash from the holders at a price equal to 101% of their aggregate principal amount plus accrued and

unpaid interest to, but not including, the date of repurchase. A “change of control triggering event” is

defined as the occurrence of both a change of control and a downgrade in the debt rating assigned to

the notes to a level below investment grade.

Net proceeds from the senior notes have been used for general corporate purposes, such as to fund

share repurchases, finance capital expenditures and operating expenses and invest in subsidiaries.

Additional sources of liquidity

The Company has additional liquidity available through its trade receivables facility and revolving credit

facility. These sources can be accessed domestically if the Company is unable to satisfy its cash

needs in the United States with cash flows provided by operations and existing cash and cash

equivalents and marketable securities.

63