Lexmark 2011 Annual Report Download - page 94

Download and view the complete annual report

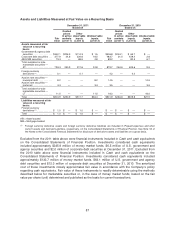

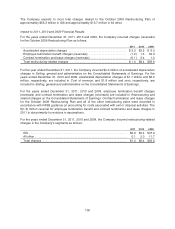

Please find page 94 of the 2011 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Additionally, as indicated in the table above, the Company transferred, on a gross basis, $11.1 million

of corporate debt and asset-backed securities from Level 2 to Level 3 during 2010. The Company has

been unable to corroborate the consensus price of these securities with a sufficient level of observable

market data to maintain Level 2 classification. The Company also transferred, on a gross basis, $8.4

million of corporate debt and mortgage-backed securities from Level 3 to Level 2 as the Company was

able to obtain information demonstrating that the prices were observable in the market as of

December 31, 2010.

Valuation Techniques

Marketable securities — general

The Company evaluates its marketable securities in accordance with Financial Accounting Standards

Board (“FASB”) guidance on accounting for investments in debt and equity securities, and has

determined that all of its investments in marketable securities should be classified as available-for-sale

and reported at fair value. The Company generally employs a market approach in valuing its

marketable securities, using quoted market prices or other observable market data when available. In

certain instances, when observable market data is lacking, fair values are determined using valuation

techniques consistent with the income approach whereby future cash flows are converted to a single

discounted amount.

The Company uses multiple third parties to report the fair values of the securities in which Lexmark is

invested, though the responsibility of valuation remains with the Company’s management. Most of the

securities’ fair values are based upon a consensus price method, whereby prices from a variety of

industry data providers are input into a distribution-curve based algorithm to determine the most

appropriate fair value. The Company utilizes various sources of pricing as well as trading and other

market data in its process of corroborating fair values and testing default level assumptions. The

Company assesses the quantity of pricing sources available, variability in the prices provided, trading

activity, and other relevant data in performing this process.

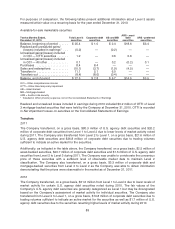

Government and agency debt securities

The Company’s government and agency debt securities are generally highly liquid investments having

multiple sources of pricing with low variability among the data providers. The consensus price method,

described previously, is used to select the most appropriate price. Fair value measurements for U.S.

government securities are most often based on quoted market prices in active markets and are

generally categorized as Level 1. U.S. agency debt securities and international government debt

securities may exhibit lower levels of market activity and are classified into the most appropriate level

according to the process described in the paragraph above.

Corporate debt securities

The corporate debt securities in which the Company is invested most often have multiple sources of

pricing with relatively low dispersion and are valued using the consensus price method. The fair values

of these securities are generally classified as Level 2. Certain of these securities, however, are

classified as Level 3 because the Company was unable to corroborate the consensus price of these

securities with a sufficient level of observable market data due to a low number of observed trades or

pricing sources. In addition, certain corporate debt securities are classified as Level 1 due to trading

volumes sufficient to indicate an active market for the securities.

Smaller amounts of commercial paper and certificates of deposit, which generally have shorter

maturities and less frequent trades, are also grouped into this fixed income sector. Such securities are

valued via mathematical calculations using observable inputs until such time that market activity

reflects an updated price. The fair values of these securities are typically classified as Level 2

measurements.

90