Lexmark 2011 Annual Report Download - page 89

Download and view the complete annual report

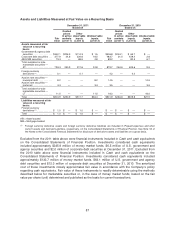

Please find page 89 of the 2011 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.application of existing fair value measurement guidance. Amendments of this nature include limiting

the concepts of valuation premise and highest and best use to the measurement of nonfinancial

assets. ASU 2011-04 also requires additional fair value disclosures including a qualitative discussion

about the sensitivity of recurring Level 3 fair value measurements and the categorization by level of the

fair value hierarchy for items that are not measured at fair value in the statement of financial position

but for which the fair value is required to be disclosed. The amendments will be effective for the

Company in the first quarter of fiscal 2012 and must be applied prospectively. Although the Company

is in the process of evaluating the impact of the new guidance, it currently believes that the changes to

the fair value measurement guidance will not have a significant impact on its financial statements.

In June 2011, the FASB issued ASU No. 2011-05, Comprehensive Income (Topic 220): Presentation

of Comprehensive Income (“ASU 2011-05”). ASU 2011-05 eliminates the option to present items of

other comprehensive income in the statement of changes in stockholders’ equity and requires an entity

to present the components of net income and other comprehensive income in either a single

continuous statement or in two separate, but consecutive, statements. The amendments in ASU

2011-05 also require an entity to present on the face of the financial statement(s) reclassification

adjustments for items that are reclassified from other comprehensive income to net income, thus

eliminating the option to disclose these items in the notes to the financial statements.

In December, 2011, the FASB issued ASU No. 2011-12, Comprehensive Income (Topic 220): Deferral

of the Effective Date for Amendments to the Presentation of Reclassifications of Items Out of

Accumulated Other Comprehensive Income in Accounting Standards Update No. 2011-05 (“ASU

2011-12”). ASU 2011-12 defers the new requirement to present reclassification adjustments on the

face of the financial statements for both interim and annual periods, reinstating the reporting

requirements related to reclassification adjustments in effect before ASU 2011-05.

ASU 2011-05 and ASU 2011-12, collectively, require retrospective application and will be effective for

the Company in the first quarter of fiscal 2012. Although early adoption is permitted, the Company has

not adopted the ASUs for its 2011 financial statements. The adoption of ASU 2011-05 and ASU

2011-12 will require changes in the presentation of the Company’s financial statements and notes but

should have no other impact on the Company.

In September 2011, the FASB issued ASU No. 2011-08, Intangibles — Goodwill and Other (Topic

350): Testing Goodwill for Impairment (“ASU 2011-08”). The amendments in ASU 2011-08 permit an

entity to first assess qualitatively whether it is necessary to perform step one of the two-step annual

goodwill impairment test required under existing guidance. Under the amended guidance, an entity is

required to perform step one only if the entity determines through its qualitative assessment that it is

more likely than not (a likelihood of more than 50 percent) that the fair value of a reporting unit is less

than its carrying amount, including goodwill. ASU 2011-08 also provides examples of events and

circumstances that an entity should consider when performing the qualitative assessment. The

examples of events and circumstances included in the amended guidance replace those used under

existing guidance to determine whether it is necessary to test goodwill for impairment during interim

periods. The amendments in ASU 2011-08 must be applied prospectively to goodwill impairment tests

performed by the Company for its 2012 fiscal year. Although the Company was permitted to early

adopt the amendments under ASU 2011-08, the Company did not apply the amended guidance to its

annual impairment tests performed in the fourth quarter of 2011. The Company is in the process of

evaluating the effect(s) of the amended guidance on its annual goodwill impairment tests but

anticipates no material impact to the Company’s financial statements upon adoption.

In December 2011, the FASB issued ASU No. 2011-11, Balance Sheet (Topic 210): Disclosures about

Offsetting Assets and Liabilities (“ASU 2011-11”). ASU 2011-11 amends the disclosure requirements

on offsetting financial instruments, requiring entities to disclose both gross information and net

information about instruments and transactions eligible for offset in the statement of financial position

85