Lexmark 2011 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2011 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

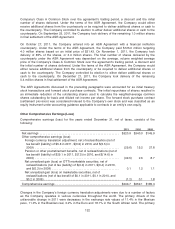

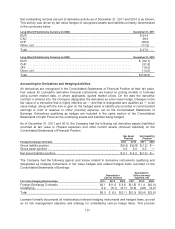

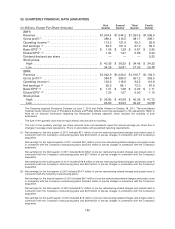

Net outstanding notional amount of derivative activity as of December 31, 2011 and 2010 is as follows.

This activity was driven by fair value hedges of recognized assets and liabilities primarily denominated

in the currencies below.

Long (Short) Positions by Currency (in USD) December 31, 2011

EUR .................................................................. $54.4

CAD .................................................................. 38.3

CHF .................................................................. (28.2)

Other, net .............................................................. (17.5)

Total .................................................................. $47.0

Long (Short) Positions by Currency (in USD) December 31, 2010

EUR .................................................................. $ (82.7)

CHF .................................................................. (31.8)

JPY................................................................... (19.5)

Other, net .............................................................. (14.5)

Total .................................................................. $(148.5)

Accounting for Derivatives and Hedging Activities

All derivatives are recognized in the Consolidated Statements of Financial Position at their fair value.

Fair values for Lexmark’s derivative financial instruments are based on pricing models or formulas

using current market data, or where applicable, quoted market prices. On the date the derivative

contract is entered into, the Company designates the derivative as a fair value hedge. Changes in the

fair value of a derivative that is highly effective as — and that is designated and qualifies as — a fair

value hedge, along with the loss or gain on the hedged asset or liability are recorded in current period

earnings in Cost of revenue or Other (income) expense, net on the Consolidated Statements of

Earnings. Derivatives qualifying as hedges are included in the same section of the Consolidated

Statements of Cash Flows as the underlying assets and liabilities being hedged.

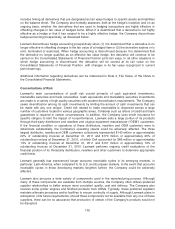

As of December 31, 2011 and 2010, the Company had the following net derivative assets (liabilities)

recorded at fair value in Prepaid expenses and other current assets (Accrued liabilities) on the

Consolidated Statements of Financial Position:

Net Asset

Position

Net (Liability)

Position

Foreign Exchange Contracts 2011 2010 2011 2010

Gross liability position ............................................ $(0.2) $(0.8) $(1.2) $—

Gross asset position ............................................. 0.3 5.0 0.2 —

Net asset (liability) position ....................................... $0.1 $4.2 $(1.0) $—

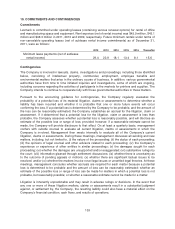

The Company had the following (gains) and losses related to derivative instruments qualifying and

designated as hedging instruments in fair value hedges and related hedged items recorded on the

Consolidated Statements of Earnings:

Recorded in

Cost of revenue

Recorded in

Other (income)

expense, net

Fair Value Hedging Relationships 2011 2010 2009 2011 2010 2009

Foreign Exchange Contracts ......................... $0.1 $11.6 $ 3.6 $(1.5) $ 1.4 $(0.4)

Underlying ........................................ 6.2 (5.1) (5.7) (0.5) (3.8) (2.2)

Total ............................................ $6.3 $ 6.5 $(2.1) $(2.0) $(2.4) $(2.6)

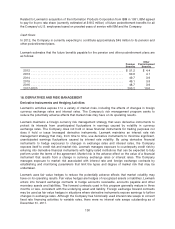

Lexmark formally documents all relationships between hedging instruments and hedged items, as well

as its risk management objective and strategy for undertaking various hedge items. This process

131