Lexmark 2011 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2011 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

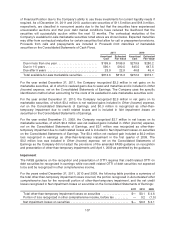

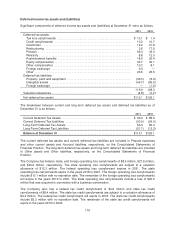

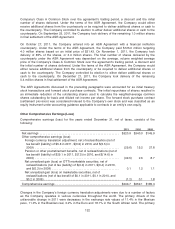

The components of Interest (income) expense, net in the Consolidated Statements of Earnings are as

follows:

2011 2010 2009

Interest (income) ................................................ $(13.4) $(15.6) $(17.9)

Interest expense ................................................ 43.3 41.9 39.3

Total .......................................................... $29.9 $ 26.3 $ 21.4

The Company capitalized interest costs of $0.3 million, $2.1 million and $3.4 million in 2011, 2010 and

2009, respectively.

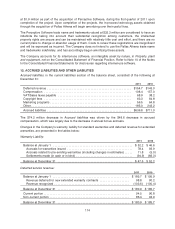

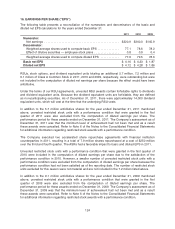

14. INCOME TAXES

Provision for Income Taxes

The Provision for income taxes consisted of the following:

2011 2010 2009

Current:

Federal ....................................................... $ 6.8 $54.9 $(22.6)

Non-U.S. ...................................................... 33.4 26.3 18.9

State and local ................................................. 6.0 7.1 1.2

46.2 88.3 (2.5)

Deferred:

Federal ....................................................... 48.8 (8.8) 47.4

Non-U.S. ...................................................... (8.7) 5.2 (7.1)

State and local ................................................. 6.4 (3.2) 3.3

46.5 (6.8) 43.6

Provision for income taxes ........................................... $92.7 $81.5 $ 41.1

Earnings before income taxes were as follows:

2011 2010 2009

U.S. ......................................................... $167.1 $178.6 $ 38.3

Non-U.S. ..................................................... 246.5 242.9 148.7

Earnings before income taxes .................................... $413.6 $421.5 $187.0

The Company realized an income tax benefit from the exercise of certain stock options and/or vesting

of certain RSUs and DSUs in 2011, 2010 and 2009 of $2.8 million, $4.5 million and $2.8 million,

respectively. This benefit resulted in a decrease in current income taxes payable.

117