Lexmark 2011 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2011 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

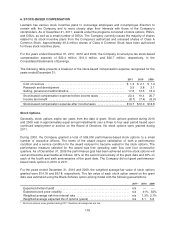

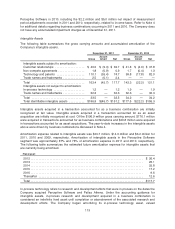

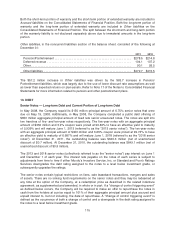

Perceptive Software in 2010, including the $2.2 million and $5.0 million net impact of measurement

period adjustments recorded in 2011 and 2010, respectively, related to income taxes. Refer to Note 4

for additional details regarding business combinations occurring in 2011 and 2010. The Company does

not have any accumulated impairment charges as of December 31, 2011.

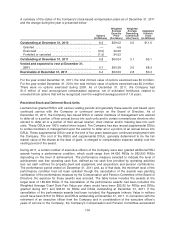

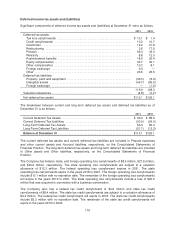

Intangible Assets

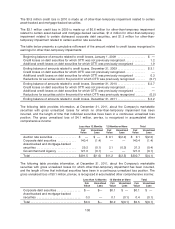

The following table summarizes the gross carrying amounts and accumulated amortization of the

Company’s intangible assets.

December 31, 2011 December 31, 2010

Accum Accum

Gross Amort Net Gross Amort Net

Intangible assets subject to amortization:

Customer relationships ................... $ 49.0 $ (9.3) $ 39.7 $ 41.8 $ (4.0) $ 37.8

Non-compete agreements ................. 1.8 (0.9) 0.9 1.7 (0.4) 1.3

Technology and patents .................. 110.1 (35.4) 74.7 99.8 (17.8) 82.0

Trade names and trademarks .............. 2.5 (0.1) 2.4 — — —

Total .................................. 163.4 (45.7) 117.7 143.3 (22.2) 121.1

Intangible assets not subject to amortization:

In-process technology .................... 1.2 — 1.2 1.9 — 1.9

Trade names and trademarks .............. 32.3 — 32.3 32.3 — 32.3

Total .................................. 33.5 — 33.5 34.2 — 34.2

Total identifiable intangible assets .......... $196.9 $(45.7) $151.2 $177.5 $(22.2) $155.3

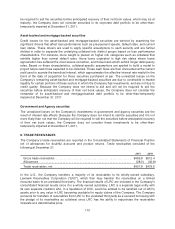

Intangible assets acquired in a transaction accounted for as a business combination are initially

recognized at fair value. Intangible assets acquired in a transaction accounted for as an asset

acquisition are initially recognized at cost. Of the $196.9 million gross carrying amount, $176.1 million

were acquired in transactions accounted for as business combinations and $20.8 million were acquired

in transactions accounted for as asset acquisitions. The year-to-date increases in the intangible assets

above were driven by business combinations discussed in Note 4.

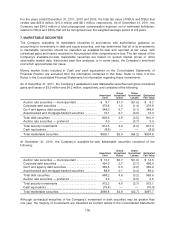

Amortization expense related to intangible assets was $23.7 million, $14.9 million and $3.2 million for

2011, 2010 and 2009, respectively. Amortization of intangible assets in the Perceptive Software

segment was approximately 87% and 78% of amortization expense in 2011 and 2010, respectively.

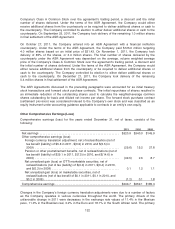

The following table summarizes the estimated future amortization expense for intangible assets that

are currently being amortized.

Fiscal year:

2012 ........................................................................ $ 26.4

2013 ........................................................................ 26.1

2014 ........................................................................ 25.8

2015 ........................................................................ 17.2

2016 ........................................................................ 9.6

Thereafter ................................................................... 12.6

Total ........................................................................ $117.7

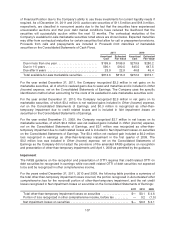

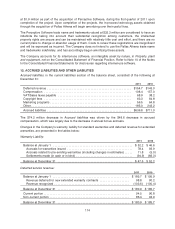

In-process technology refers to research and development efforts that were in process on the dates the

Company acquired Perceptive Software and Pallas Athena. Under the accounting guidance for

intangible assets, in-process research and development acquired in a business combination is

considered an indefinite lived asset until completion or abandonment of the associated research and

development efforts. The Company began amortizing its in-process technology asset, valued

113