Lexmark 2011 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2011 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

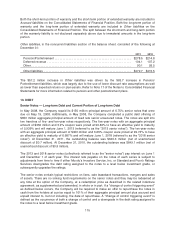

In September 2011, the trade receivables facility was amended by extending the term of the facility to

September 28, 2012. The maximum capital availability under the facility remains at $125 million under

the amended agreement. There were no secured borrowings outstanding under the trade receivables

facility at December 31, 2011 or December 31, 2010.

This facility contains customary affirmative and negative covenants as well as specific provisions

related to the quality of the accounts receivables transferred. As collections reduce previously

transferred receivables, the Company may replenish these with new receivables. Lexmark bears a

limited risk of bad debt losses on the trade receivables transferred, since the Company over-

collateralizes the receivables transferred with additional eligible receivables. Lexmark addresses this

risk of loss in its allowance for doubtful accounts. Receivables transferred to the unrelated third-party

may not include amounts over 90 days past due or concentrations over certain limits with any one

customer. The facility also contains customary cash control triggering events which, if triggered, could

adversely affect the Company’s liquidity and/or its ability to obtain secured borrowings. A downgrade in

the Company’s credit rating would reduce the amount of secured borrowings available under the

facility.

Expenses incurred under this program totaled $0.6 million, $0.6 million and $0.4 million in 2011, 2010

and 2009 respectively. The expenses are primarily included in Interest (income) expense, net on the

Consolidated Statements of Earnings in 2011 and 2010. In 2009, the expenses are primarily included

in Other (income) expense, net on the Consolidated Statements of Earnings.

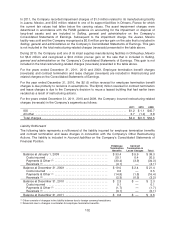

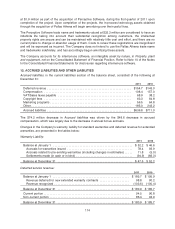

9. INVENTORIES

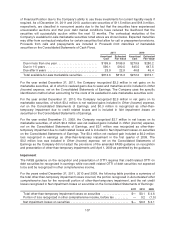

Inventories consisted of the following at December 31:

2011 2010

Work in process ....................................................... $ 33.7 $ 61.6

Finished goods ........................................................ 301.8 304.5

Inventories ........................................................... $335.5 $366.1

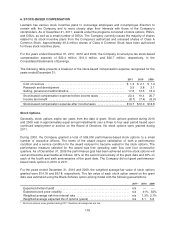

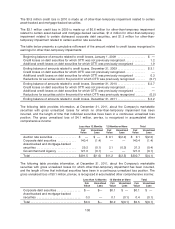

10. PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment consisted of the following at December 31:

Useful Lives

(Years) 2011 2010

Land and improvements ................................. 20 $ 30.0 $ 33.7

Buildings and improvements ............................. 10-35 539.9 548.0

Machinery and equipment ............................... 2-10 882.4 860.8

Information systems .................................... 3-4 125.1 111.0

Internal use software .................................... 3-5 479.2 410.1

Leased products ....................................... 2-6 100.1 77.0

Furniture and other ..................................... 7 52.9 58.2

2,209.6 2,098.8

Accumulated depreciation ............................... (1,320.8) (1,194.0)

Property, plant and equipment, net ........................ $ 888.8 $ 904.8

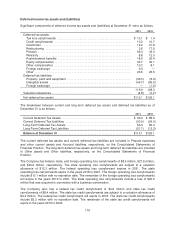

Depreciation expense was $196.0 million, $181.0 million and $209.1 million in 2011, 2010 and 2009,

respectively.

Leased products refers to hardware leased by Lexmark to certain customers as part of the Company’s

ISS operations. The cost of the hardware is amortized over the life of the contracts, which have been

111