Lexmark 2011 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2011 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The $129.4 million decrease in cash-flow from operating activities from 2010 to 2011 was driven by the

following factors.

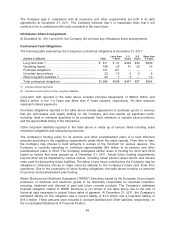

The decrease in Accrued liabilities and unfavorable change in Other assets and liabilities, collectively,

was $191.6 million more in 2011 than in 2010. The largest factors behind the YTY movement included

annual incentive compensation payments, cash paid for income taxes, pension funding and increase in

capital lease receivable.

Annual incentive compensation payments were approximately $65 million in 2011 compared to $29

million in 2010, driven by the improvement in 2010 full year results compared to that of 2009. Cash

paid for income taxes was $93 million in 2011, compared to $77 million in 2010. The Company also

made approximately $31 million of pension and post retirement plan payments in 2011 compared to

the net contribution of $9 million in 2010. The increase of capital lease receivable YTY generated an

additional unfavorable impact of $32 million and is due to the growth in managed print services

arrangements in 2011.

Accounts payable decreased $50.6 million in 2011 while they increased $22.7 million in 2010. The

decrease in 2011 is driven by the shorter payment cycle along with decreased spending levels.

The activities above were partially offset by the following factors.

Trade receivables balances decreased $24 million in 2011 while they increased $28.5 million in 2010,

excluding receivables recognized on the date of acquisitions. This $52.5 million fluctuation between the

activity in 2011 and that of 2010 is driven by the timing of revenue in the fourth quarter as well as less

delinquencies.

Inventories decreased $30.6 million in 2011 while they increased $8.8 million in 2010. This $39.4

million fluctuation results from decreased spending in 2011 relative to 2010.

Refer to the contractual cash obligations table that follows for additional information regarding items

that will likely impact the Company’s future cash flows.

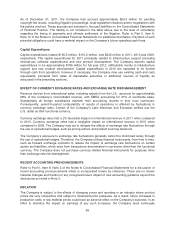

The $118.2 million increase in cash flow from operating activities from 2009 to 2010 was driven by the

following factors.

Net earnings increased $194.1 million for 2010 as compared to 2009. The non-cash adjustment for

depreciation and amortization decreased $15.8 million YTY driven by the decrease in accelerated

depreciation in 2010 related to the Company’s restructuring actions.

Accounts payable increased $22.7 million in 2010 and decreased $47.8 million in 2009. The $70.5

million fluctuation between the activity in 2010 and that of 2009 is primarily driven by greater demand in

2010 coupled with a longer payment cycle. Furthermore, the year-end Accounts payable balance was

considerably higher at December 31, 2008 compared to December 31, 2009 and is a significant factor

in the Company’s 2009 and 2010 cash flows, respectively.

The activities above were partially offset by the following factors.

Inventories balances increased $8.8 million in 2010 and decreased $81.2 million in 2009. The $90.0

million fluctuation between the activity in 2010 and that of 2009 is primarily due to actions taken by the

Company in 2009 in response to challenging economic conditions that negatively impacted the

Company at that time.

Trade receivables balances increased $28.5 million in 2010 (excluding receivables recognized on the

date of acquisition of Perceptive Software) and decreased $2.3 million in 2009. The $30.8 million

59