Lexmark 2011 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2011 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

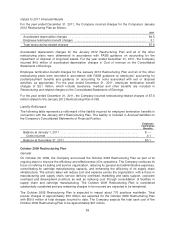

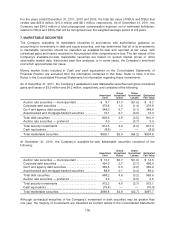

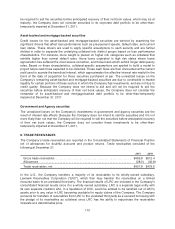

The following table provides information, at December 31, 2010, about the Company’s marketable

securities with gross unrealized losses for which no other-than-temporary impairment has been

incurred, and the length of time that individual securities have been in a continuous unrealized loss

position. The gross unrealized loss of $3.6 million, pre-tax, is recognized in accumulated other

comprehensive income:

Less than 12 Months 12 Months or More Total

Fair Unrealized Fair Unrealized Fair Unrealized

Value Loss Value Loss Value Loss

Auction rate securities ............... $ — $ — $15.9 $(2.4) $ 15.9 $(2.4)

Corporate debt securities ............ 183.7 (0.6) 5.4 — 189.1 (0.6)

Asset-backed and mortgage-backed

securities ....................... 30.9 (0.2) 3.8 (0.2) 34.7 (0.4)

Government and Agency ............ 163.4 (0.2) — — 163.4 (0.2)

Total ............................... $378.0 $(1.0) $25.1 $(2.6) $403.1 $(3.6)

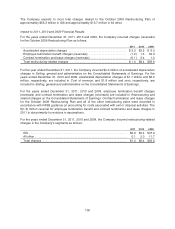

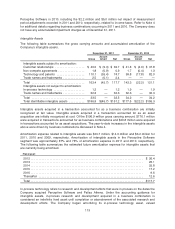

The following table provides information, at December 31, 2010, about the Company’s marketable

securities with gross unrealized losses for which other-than-temporary impairment has been incurred,

and the length of time that individual securities have been in a continuous unrealized loss position. The

gross unrealized loss of $0.1 million, pre-tax, is recognized in accumulated other comprehensive

income:

Less than 12 Months 12 Months or More Total

Fair Unrealized Fair Unrealized Fair Unrealized

Value Loss Value Loss Value Loss

Corporate debt securities ............... $— $— $0.1 $(0.1) $0.1 $(0.1)

Asset-backed and mortgage-backed

securities .......................... — — 0.2 — 0.2 —

Total ................................ $— $— $0.3 $(0.1) $0.3 $(0.1)

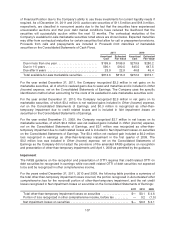

Auction rate securities

The Company’s valuation process for its auction rate security portfolio begins with a credit analysis of

each instrument. Under this method, the security is analyzed for factors impacting its future cash flows,

such as the underlying collateral, credit ratings, credit insurance or other guarantees, and the level of

seniority of the specific tranche of the security. Future cash flows are projected incorporating certain

security specific assumptions such as the ratings outlook, the assumption that the auction market will

remain illiquid and that the security’s interest rate will continue to be set at the maximum applicable

rate, and that the security will not be redeemed until its mandatory redemption date. The methodology

for determining the appropriate discount rate uses market-based yield indicators and the underlying

collateral as a baseline for determining the appropriate yield curve, and then adjusting the resultant

rate on the basis of the credit and structural analysis of the security. The unrealized losses on the

Company’s auction rate portfolio are a result of the illiquidity in this market sector and are not due to

credit quality. The Company has the intent to hold these securities until liquidity in the market or

optional issuer redemption occurs, and it is not more likely than not that the Company will be required

to sell these securities before anticipated recovery. Additionally, if the Company requires capital, the

Company has available liquidity through its trade receivables facility and revolving credit facility.

Corporate debt securities

Unrealized losses on the Company’s corporate debt securities are attributable to current economic

conditions and are not due to credit quality. Because the Company does not intend to sell and will not

109