Lexmark 2011 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2011 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Company’s Class A Common Stock over the agreement’s trading period, a discount and the initial

number of shares delivered. Under the terms of the ASR Agreement, the Company would either

receive additional shares from the counterparty or be required to deliver additional shares or cash to

the counterparty. The Company controlled its election to either deliver additional shares or cash to the

counterparty. On September 23, 2011, the Company took delivery of the remaining 1.0 million shares

in final settlement of the ASR Agreement.

On October 27, 2011, the Company entered into an ASR Agreement with a financial institution

counterparty. Under the terms of the ASR Agreement, the Company paid $125.0 million targeting

4.0 million shares based on an initial price of $31.43. On November 1, 2011, the Company took

delivery of 85% of the shares, or 3.4 million shares. The final number of shares delivered by the

counterparty under the ASR Agreement was dependent on the average, volume weighted average

price of the Company’s Class A Common Stock over the agreement’s trading period, a discount and

the initial number of shares delivered. Under the terms of the ASR Agreement, the Company would

either receive additional shares from the counterparty or be required to deliver additional shares or

cash to the counterparty. The Company controlled its election to either deliver additional shares or

cash to the counterparty. On December 21, 2011, the Company took delivery of the remaining

0.4 million shares in final settlement of the ASR Agreement.

The ASR Agreements discussed in the preceding paragraphs were accounted for as initial treasury

stock transactions and forward stock purchase contracts. The initial repurchase of shares resulted in

an immediate reduction of the outstanding shares used to calculate the weighted-average common

shares outstanding for basic and diluted net income per share. The forward stock purchase contract

(settlement provision) was considered indexed to the Company’s own stock and was classified as an

equity instrument under accounting guidance applicable to contracts in an entity’s own equity.

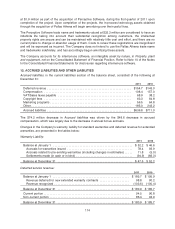

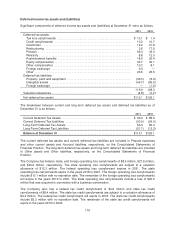

Other Comprehensive Earnings (Loss)

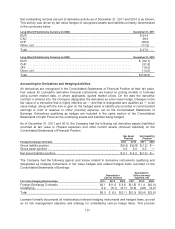

Comprehensive earnings (loss) for the years ended December 31, net of taxes, consists of the

following:

2011 2010 2009

Net earnings ................................................... $320.9 $340.0 $145.9

Other comprehensive earnings (loss):

Foreign currency translation adjustment, net of reclassification (net of

tax benefit (liability) of $5.8 in 2011, $(0.9) in 2010, and $(5.5) in

2009) ...................................................... (29.6) 15.2 27.8

Pension or other postretirement benefits, net of reclassifications (net of

tax benefit (liability) of $29.1 in 2011, $(7.5) in 2010, and $(14.6) in

2009) ...................................................... (49.5) 2.6 8.7

Net unrealized gain (loss) on OTTI marketable securities, net of

reclassifications (net of tax (liability) of $(0.0) in 2011, $(0.4) in 2010,

and $(0.3) in 2009) ........................................... 0.1 1.2 1.1

Net unrealized gain (loss) on marketable securities, net of

reclassifications (net of tax benefit of $0.1 in 2011, $0.1 in 2010, and

$0.2 in 2009) ................................................ (1.2) 0.1 1.8

Comprehensive earnings ......................................... $240.7 $359.1 $185.3

Changes in the Company’s foreign currency translation adjustments were due to a number of factors

as the Company operates in various currencies throughout the world. The primary drivers of the

unfavorable change in 2011 were decreases in the exchange rate values of 11.4% in the Mexican

peso, 11.0% in the Brazilian real, 3.2% in the Euro and 18.1% in the South African rand. The primary

122