Lexmark 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

fluctuation between the activity in 2010 and that of 2009 is primarily driven by the increase in revenues

in the fourth quarter of 2010 compared to the fourth quarter of 2009. The increase in the Company’s

days of sales outstanding at year end 2010 was largely due to the timing of sales as indicated by the

slight improvement in delinquent receivables at year end 2010 compared to year end 2009.

The net decrease in Accrued liabilities and Other assets and liabilities, collectively, was $4.7 million

less in 2010 compared to that of 2009. The fluctuation between the activity in 2010 and that of 2009

was the result of various offsetting factors, including both cash transactions as well as the effect of

accruals of expected future operating cash receipts and payments. Notable fluctuations in cash

transactions included pension funding and cash paid for income taxes. The Company made

$92.4 million of pension and postretirement payments in 2009, driven by the steep decline in the fair

value of pension plan assets in late 2008, compared to only $8.7 million in 2010. Cash paid for income

taxes, net of refunds, was $77.4 million in 2010 compared to $41.3 million in 2009.

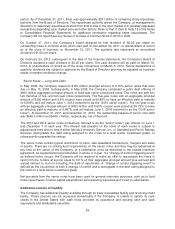

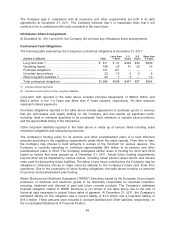

Cash conversion days

2011 2010 2009

Days of sales outstanding .............................................. 39 39 36

Days of inventory ..................................................... 45 46 47

Days of payables ..................................................... 66 68 67

Cash conversion days ................................................. 18 18 16

Cash conversion days represent the number of days that elapse between the day the Company pays

for materials and the day it collects cash from its customers. Cash conversion days are equal to the

days of sales outstanding plus days of inventory less days of payables.

The days of sales outstanding are calculated using the period-end Trade receivables balance, net of

allowances, and the average daily revenue for the quarter.

The days of inventory are calculated using the period-end net Inventories balance and the average

daily cost of revenue for the quarter.

The days of payables are calculated using the period-end Accounts payable balance and the average

daily cost of revenue for the quarter.

Please note that cash conversion days presented above may not be comparable to similarly titled

measures reported by other registrants. The cash conversion days in the table above may not foot due

to rounding.

Investing activities

The $533.7 million decrease in net cash flows used for investing activities during 2011 compared to

that of 2010 was driven by the $298.5 million YTY net decrease in marketable securities investments

as well as the $232.1 million decrease in business acquisitions.

The $402.4 million increase in net cash flows used for investing activities during 2010 compared to that

of 2009 was driven by the $263.4 million YTY increase in business acquisitions as well as the $226.3

million YTY net increase in marketable securities investments. This activity was offset partially by the

$80.8 million YTY decrease in capital spending.

60