Lexmark 2011 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2011 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

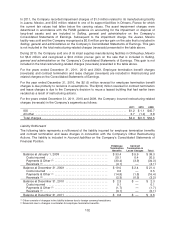

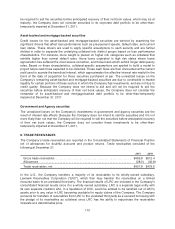

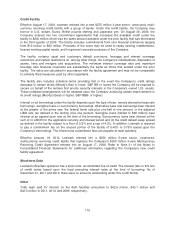

classified as operating leases based on the terms of the arrangements. The accumulated depreciation

related to the Company’s leased products was $58.3 million and $43.2 million at year-end 2011 and

2010, respectively.

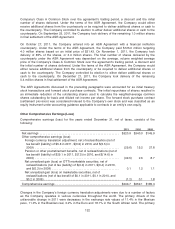

The Company accounts for its internal-use software, an intangible asset by nature, in Property, plant

and equipment, net on the Consolidated Statements of Financial Position. The net carrying amounts of

internal-use software at December 31, 2011 and 2010 were $236.9 million and $227.9 million,

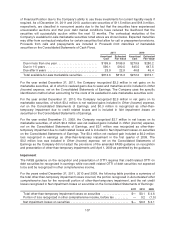

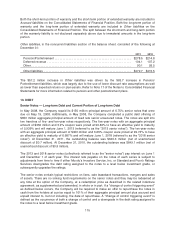

respectively. The following table summarizes the estimated future amortization expense for

internal-use software currently being amortized.

Fiscal year:

2012 ........................................................................ $ 57.5

2013 ........................................................................ 52.0

2014 ........................................................................ 43.5

2015 ........................................................................ 22.8

2016 ........................................................................ 3.3

Thereafter ................................................................... —

Total ........................................................................ $179.1

The table above does not include future amortization expense for internal-use software that is not

currently being amortized because the assets are not ready for their intended use.

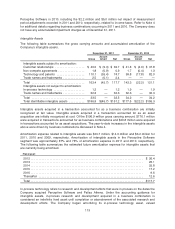

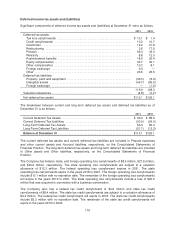

Accelerated depreciation and disposal of long-lived assets

The Company’s restructuring actions have resulted in shortened estimated useful lives of certain

machinery and equipment and buildings and subsequent disposal of machinery and equipment no

longer in use. Refer to Note 5 to the Consolidated Financial Statements for a discussion of these

actions and the impact on earnings.

Long-lived assets held for sale

Certain of the Company’s long-lived assets held for sale were subject to nonrecurring fair value

measurements during 2011. Refer to Notes 3 and 5 of the Notes to the Consolidated Financial

Statements for a discussion of these assets.

11. GOODWILL AND INTANGIBLE ASSETS

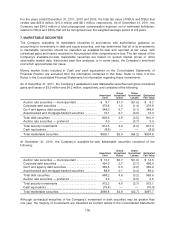

Goodwill

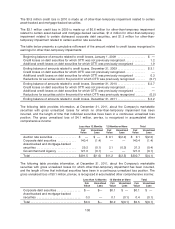

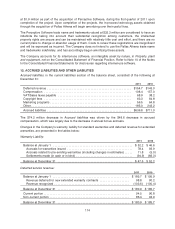

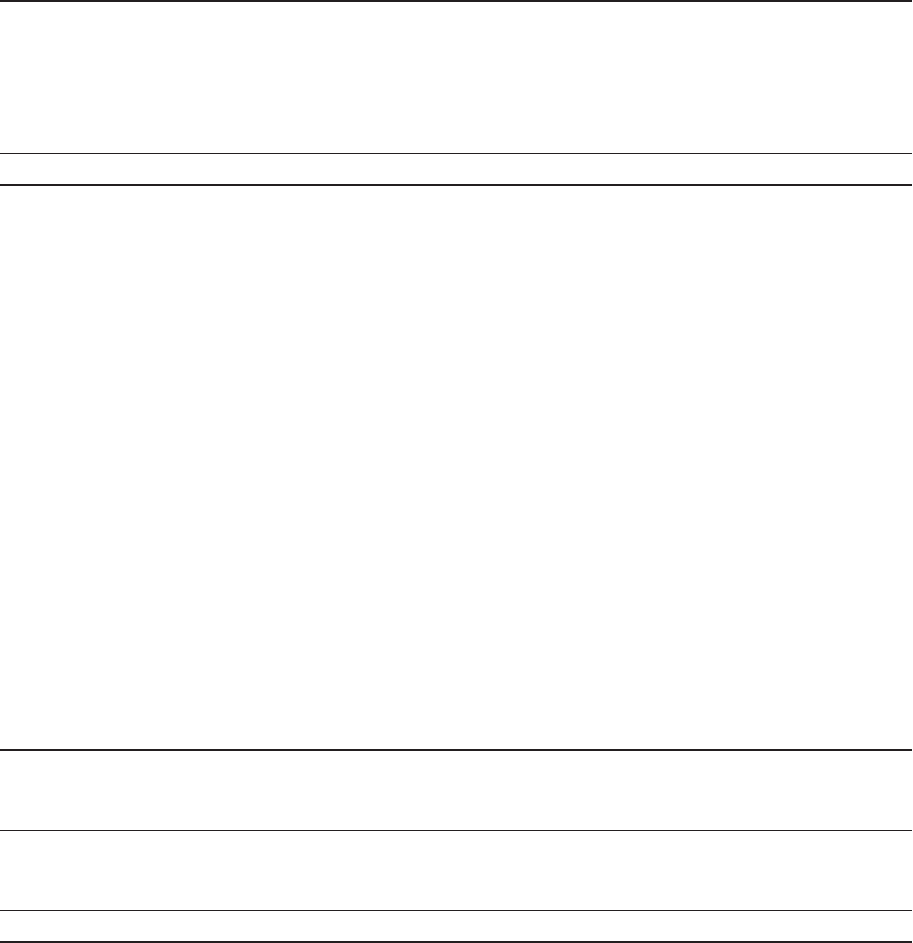

The following table summarizes the changes in the carrying amount of goodwill for each reportable

segment and in total during 2011 and 2010.

ISS

Perceptive

Software Total

Balance at January 1, 2010 ..................................... $23.7 $ — $ 23.7

Goodwill acquired during the period .............................. 1.8 161.8 163.6

Foreign currency translation ..................................... — — —

Balance at December 31, 2010 .................................. 25.5 161.8 187.3

Goodwill acquired during the period .............................. — 33.5 33.5

Foreign currency translation ..................................... (2.6) (1.8) (4.4)

Balance at December 31, 2011 .................................. $22.9 $193.5 $216.4

The Company has recorded $33.5 million of goodwill related to the acquisition of Pallas Athena in

2011. The Company has also recorded $161.8 million of goodwill related to the acquisition of

112