Lexmark 2011 Annual Report Download - page 136

Download and view the complete annual report

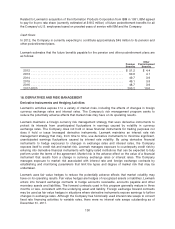

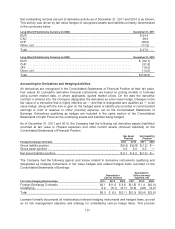

Please find page 136 of the 2011 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.includes linking all derivatives that are designated as fair value hedges to specific assets and liabilities

on the balance sheet. The Company also formally assesses, both at the hedge’s inception and on an

ongoing basis, whether the derivatives that are used in hedging transactions are highly effective in

offsetting changes in fair value of hedged items. When it is determined that a derivative is not highly

effective as a hedge or that it has ceased to be a highly effective hedge, the Company discontinues

hedge accounting prospectively, as discussed below.

Lexmark discontinues hedge accounting prospectively when (1) it is determined that a derivative is no

longer effective in offsetting changes in the fair value of a hedged item or (2) the derivative expires or is

sold, terminated or exercised. When hedge accounting is discontinued because it is determined that

the derivative no longer qualifies as an effective fair value hedge, the derivative will continue to be

carried on the Consolidated Statements of Financial Position at its fair value. In all other situations in

which hedge accounting is discontinued, the derivative will be carried at its fair value on the

Consolidated Statements of Financial Position, with changes in its fair value recognized in current

period earnings.

Additional information regarding derivatives can be referenced in Note 3, Fair Value, of the Notes to

the Consolidated Financial Statements.

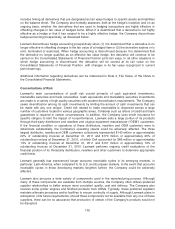

Concentrations of Risk

Lexmark’s main concentrations of credit risk consist primarily of cash equivalent investments,

marketable securities and trade receivables. Cash equivalents and marketable securities investments

are made in a variety of high quality securities with prudent diversification requirements. The Company

seeks diversification among its cash investments by limiting the amount of cash investments that can

be made with any one obligor. Credit risk related to trade receivables is dispersed across a large

number of customers located in various geographic areas. Collateral such as letters of credit and bank

guarantees is required in certain circumstances. In addition, the Company uses credit insurance for

specific obligors to limit the impact of nonperformance. Lexmark sells a large portion of its products

through third-party distributors and resellers and original equipment manufacturer (“OEM”) customers.

If the financial condition or operations of these distributors, resellers and OEM customers were to

deteriorate substantially, the Company’s operating results could be adversely affected. The three

largest distributor, reseller and OEM customers collectively represented $140 million or approximately

22% of outstanding invoices at December 31, 2011 and $170 million or approximately 25% of

outstanding invoices at December 31, 2010, of which Dell accounted for $85 million or approximately

13% of outstanding invoices at December 31, 2011 and $107 million or approximately 16% of

outstanding invoices at December 31, 2010. Lexmark performs ongoing credit evaluations of the

financial position of its third-party distributors, resellers and other customers to determine appropriate

credit limits.

Lexmark generally has experienced longer accounts receivable cycles in its emerging markets, in

particular, Latin America, when compared to its U.S. and European markets. In the event that accounts

receivable cycles in these developing markets lengthen further, the Company could be adversely

affected.

Lexmark also procures a wide variety of components used in the manufacturing process. Although

many of these components are available from multiple sources, the Company often utilizes preferred

supplier relationships to better ensure more consistent quality, cost and delivery. The Company also

sources some printer engines and finished products from OEMs. Typically, these preferred suppliers

maintain alternate processes and/or facilities to ensure continuity of supply. Although Lexmark plans in

anticipation of its future requirements, should these components not be available from any one of these

suppliers, there can be no assurance that production of certain of the Company’s products would not

be disrupted.

132