Lexmark 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.during 2011 with respect to OTTI of the Company’s marketable securities. Specifically regarding the

Company’s auction rate securities, the most illiquid securities in the portfolio, Lexmark has previously

recognized OTTI on only one security due to credit events involving the issuer and the insurer.

Because of the Company’s liquidity position, it is not more likely than not that the Company will be

required to sell the auction rate securities until liquidity in the market or optional issuer redemption

occurs. The Company could also hold the securities to maturity if it chooses. Additionally, if Lexmark

required capital, the Company has available liquidity through its accounts receivable program and

revolving credit facility. Given these circumstances, the Company would only have to recognize OTTI

on its auction rate securities if the present value of the expected cash flows is less than the amortized

cost of the individual security. There have been no realized losses from the sale or redemption of

auction rate securities.

Level 3 fair value measurements are based on inputs that are unobservable and significant to the

overall valuation. Level 3 measurements were 4.5% of the Company’s total available-for-sale

marketable securities portfolio at December 31, 2011 compared to 3.1% at December 31, 2010.

Refer to Part II, Item 8, Note 3 of the Notes to Consolidated Financial Statements for additional

information regarding fair value measurements. Refer to Part II, Item 8, Note 7 of the Notes to

Consolidated Financial Statements for additional information regarding marketable securities.

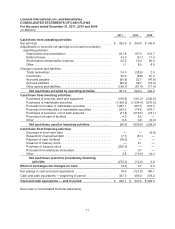

Capital expenditures

The Company invested $156.5 million, $161.2 million, and $242 million into Property, plant and

equipment for the years 2011, 2010 and 2009, respectively. Further discussion regarding 2011 capital

expenditures as well as anticipated spending for 2012 are provided near the end of Item 7.

Financing activities

The fluctuations in the net cash flows used for financing activities were principally due to the

Company’s share repurchases. In 2011, cash flows used for financing activities were $272.3 million,

due mainly to share repurchases of $250 million, dividend payment of $18 million as well as the $7.1

million repayment of debt assumed by the Company in the fourth quarter acquisition of Pallas Athena.

In 2010, cash flows used for financing activities were $12.3 million due mainly to the decrease in bank

overdrafts of $10.0 million included in Other as well as the $3.1 million repayment of long term debt

that was assumed by the Company in the second quarter acquisition of Perceptive Software. In 2009,

cash flows provided by financing activities were $3.8 million due mainly to the increase in bank

overdrafts of $9.9 million included in Other offset partially by the $6.6 million decrease in short-term

debt of the Company’s subsidiary in Brazil during the period. Refer to the sections that follow for

additional information regarding these financing activities.

Intra-period financing activities

Bank overdrafts and other financing sources were utilized to supplement daily cash needs of the

Company and its subsidiaries in 2011. Such borrowings were repaid in very short periods of time,

generally in a matter of few days, and were not material to the Company’s overall liquidity position or

its financial statements.

Share repurchases and dividend payments

The Company’s objective going forward is to return more than 50 percent of free cash flow (after

operating and capital investment needs) to its shareholders through dividends and share repurchases.

During 2011, the Company repurchased approximately 7.9 million shares of its Class A Common Stock

at a cost of $250 million through two accelerated share repurchase agreements executed during the

62