Lexmark 2011 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2011 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

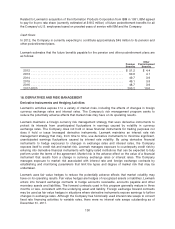

Legal proceedings

Lexmark v. Static Control Components, Inc. & Lexmark v. Clarity Imaging Technologies, Inc.

On December 30, 2002 (“02 action”) and March 16, 2004 (“04 action”), the Company filed claims

against Static Control Components, Inc. (“SCC”) in the U.S. District Court for the Eastern District of

Kentucky (the “District Court”) alleging violation of the Company’s intellectual property and state law

rights. Similar claims in a separate action were filed by the Company in the District Court against

Clarity Imaging Technologies, Inc. (“Clarity”) on October 8, 2004. SCC and Clarity have filed

counterclaims against the Company in the District Court alleging that the Company engaged in anti-

competitive and monopolistic conduct and unfair and deceptive trade practices in violation of the

Sherman Act, the Lanham Act and state laws. SCC has stated in its legal documents that it is seeking

approximately $17.8 million to $19.5 million in damages for the Company’s alleged anticompetitive

conduct and approximately $1 billion for Lexmark’s alleged violation of the Lanham Act. Clarity has not

stated a damage dollar amount. SCC and Clarity are seeking treble damages, attorney fees, costs and

injunctive relief. On September 28, 2006, the District Court dismissed the counterclaims filed by SCC

that alleged the Company engaged in anti-competitive and monopolistic conduct and unfair and

deceptive trade practices in violation of the Sherman Act, the Lanham Act and state laws. On

October 13, 2006, SCC filed a Motion for Reconsideration of the District Court’s Order dismissing

SCC’s claims, or in the alternative, to amend its pleadings, which the District Court denied on June 1,

2007. On June 20, 2007, the District Court Judge ruled that SCC directly infringed one of Lexmark’s

patents-in-suit. On June 22, 2007, the jury returned a verdict that SCC did not induce infringement of

Lexmark’s patents-in-suit. SCC has filed motions with the District Court seeking attorneys’ fees, cost

and damages for the period that a preliminary injunction was in place that prevented SCC from selling

certain microchips for some models of the Company’s toner cartridges. The Company has responded

to these motions and they are pending with the District Court. Appeal briefs for the 02 and 04 actions

have been filed with the U.S. Court of Appeals for the Sixth Circuit.

The Company has not established an accrual for the SCC litigation, because it has not determined that

a loss with respect to such litigation is probable. Although there is a reasonable possibility of a potential

loss with respect to the SCC litigation, with SCC’s claims being dismissed at the summary judgment

stage of the litigation and presently on appeal, the Company does not believe a reasonable estimate of

the range of possible loss is currently possible in view of the uncertainty regarding the amount of

damages, if any, that could be awarded in this matter.

In the Clarity litigation, the proceedings are in the discovery phase. Clarity has not stated the amount of

damages it would seek in trial. The Company has not established an accrual for the Clarity litigation,

because it has not determined that a loss with respect to such litigation is probable. Although there is a

reasonable possibility of a potential loss with respect to the Clarity litigation, since the litigation is in the

early stage of the proceedings where only limited discovery has occurred and an amount of damages

sought has not been stated, the Company does not believe a reasonable estimate of the range of

possible loss is currently possible in view of the uncertainty regarding the amount of damages, if any,

that could be awarded in this matter.

Molina v. Lexmark

On August 31, 2005 former Company employee Ron Molina filed a class action lawsuit in the California

Superior Court for Los Angeles under a California employment statute which in effect prohibits the

forfeiture of vacation time accrued. This statute has been used to invalidate California employers’ “use

or lose” vacation policies. The class is comprised of less than 200 current and former California

employees of the Company. The trial was bifurcated into a liability phase and a damages phase. On

May 1, 2009, the trial court Judge brought the liability phase to a conclusion with a ruling that the

Company’s vacation and personal choice day’s policies from 1991 to the present violated California

law. In a Statement of Decision, received by the Company on August 27, 2010, the trial court Judge

awarded the class members approximately $8.3 million in damages which included waiting time

134