Lexmark 2011 Annual Report Download - page 81

Download and view the complete annual report

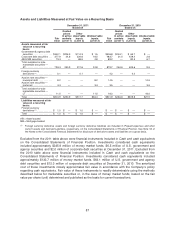

Please find page 81 of the 2011 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Long-Lived Assets Held and Used:

Lexmark performs reviews for the impairment of long-lived assets whenever events or changes in

circumstances indicate that the carrying amount of an asset may not be recoverable. If the estimated

undiscounted future cash flows expected to result from the use of the assets and their eventual

disposition are insufficient to recover the carrying value of the assets, then an impairment loss is

recognized based upon the excess of the carrying value of the assets over the fair value of the assets.

Fair value is determined based on the highest and best use of the assets considered from the

perspective of market participants.

Lexmark also reviews any legal and contractual obligations associated with the retirement of its long-

lived assets and records assets and liabilities, as necessary, related to such obligations. The asset

recorded is amortized over the useful life of the related long-lived tangible asset. The liability recorded

is relieved when the costs are incurred to retire the related long-lived tangible asset. The Company’s

asset retirement obligations are currently not material to the Company’s Consolidated Statements of

Financial Position.

Financing Receivables:

The Company assesses and monitors credit risk associated with financing receivables, namely sales-

type capital lease receivables, through an analysis of both commercial risk and political risk associated

with the customer financing. Internal credit quality indicators are developed by the Company’s credit

management function, taking into account the customer’s net worth, payment history, long term debt

ratings and/or other information available from recognized credit rating services. If such information is

not available, the Company estimates a rating based on its analysis of the customer’s audited financial

statements prepared and certified in accordance with recognized generally accepted accounting

principles. The portfolio is assessed on an annual basis for significant changes in credit ratings or other

information indicating an increase in exposure to credit risk. Quantitative disclosures related to

financing receivables have been omitted from the Notes to Consolidated Financial Statements as these

balances represent less than 2% of the Company’s total assets.

Environmental Remediation Obligations:

Lexmark accrues for losses associated with environmental remediation obligations when such losses

are probable and reasonably estimable. In the early stages of a remediation process, particular

components of the overall obligation may not be reasonably estimable. In this circumstance, the

Company recognizes a liability for the best estimate (or the minimum amount in a range if no best

estimate is available) of its allocable share of the cost of the remedial investigation-feasibility study,

consultant and external legal fees, corrective measures studies, monitoring, and any other component

remediation costs that can be reasonably estimated. Accruals are adjusted as further information

develops or circumstances change. Recoveries from other parties are recorded as assets when their

receipt is deemed probable.

Waste Obligation:

Waste Electrical and Electronic Equipment (“WEEE”) Directives issued by the European Union require

producers of electrical and electronic goods to be financially responsible for specified collection,

recycling, treatment and disposal of past and future covered products. The Company’s estimated

liability for these costs involves a number of uncertainties and takes into account certain assumptions

and judgments including average collection costs, return rates and product lives. The Company adjusts

its liability, as necessary, when a sufficient level of entity-specific experience indicates a change in

estimate is warranted.

77