Lexmark 2011 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2011 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

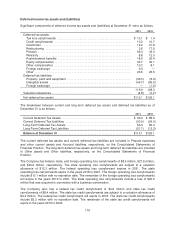

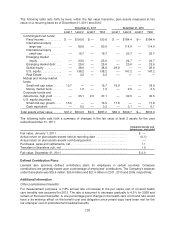

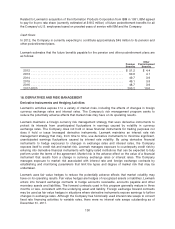

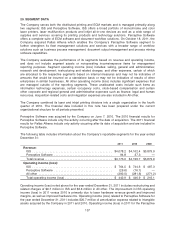

The following table sets forth by level, within the fair value hierarchy, plan assets measured at fair

value on a recurring basis as of December 31, 2011 and 2010:

December 31, 2011 December 31, 2010

Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3 Total

Commingled trust funds:

Fixed income ........... $ — $190.6 $ — 190.6 $ — $184.4 $— $184.4

International equity

large-cap ............ — 80.9 — 80.9 — 114.0 — 114.0

International equity

small-cap ............ — 16.7 — 16.7 — 20.7 — 20.7

Emerging market

equity ............... — 23.0 — 23.0 — 24.7 — 24.7

Emerging market debt . . . — 25.6 — 25.6 — 23.6 — 23.6

Global equity ........... — 38.6 — 38.6 29.6 — — 29.6

U.S. equity ............. — 138.2 — 138.2 — 147.2 — 147.2

Real Estate ............ — 3.2 — 3.2 — — — —

Mutual and money market

funds:

Small mid-cap value ..... 15.7 — — 15.7 18.9 — — 18.9

Money market fund ...... — 1.9 — 1.9 — 2.5 — 2.5

Corporate bonds and

debentures, high yield ..... — 35.1 2.0 37.1 — 32.5 — 32.5

U.S. equity securities:

Small mid-cap growth .... 15.5 — — 15.5 17.8 — — 17.8

Cash equivalent ........ — 0.2 — 0.2 — 0.1 — 0.1

Total assets at fair value ..... $31.2 $554.0 $2.0 $587.2 $66.3 $549.7 $— $616.0

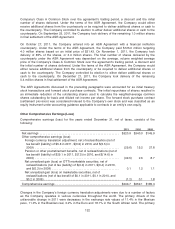

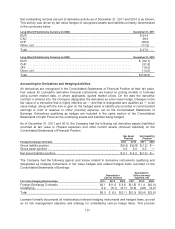

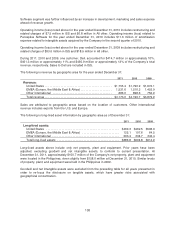

The following table sets forth a summary of changes in the fair value of level 3 assets for the year

ended December 31, 2011:

Corporate bonds and

debentures, high yield

Fair value, January 1, 2011 ............................................. $ —

Actual return on plan assets-assets held at reporting date .................... (0.1)

Actual return on plan assets-assets sold during period ....................... —

Purchases, sales and settlements, net .................................... 1.1

Transfers in/(transfers out), net .......................................... 1.0

Fair value, December 31, 2011 .......................................... $2.0

Defined Contribution Plans

Lexmark also sponsors defined contribution plans for employees in certain countries. Company

contributions are generally based upon a percentage of employees’ contributions. The Company’s expense

under these plans was $25.6 million, $23.6 million and $21.4 million in 2011, 2010 and 2009, respectively.

Additional Information

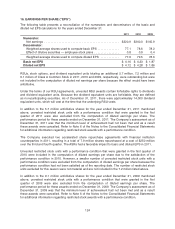

Other postretirement benefits:

For measurement purposes, a 7.8% annual rate of increase in the per capita cost of covered health

care benefits was assumed for 2012. The rate is assumed to decrease gradually to 4.5% for 2028 and

remain at that level thereafter. A one-percentage-point change in the health care cost trend rate would

have a de minimus effect on the benefit cost and obligation since preset caps have been met for the

net employer cost of postretirement medical benefits.

129