Lexmark 2011 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2011 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

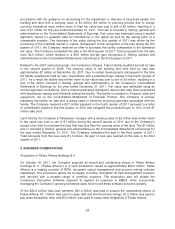

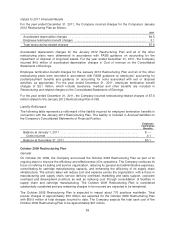

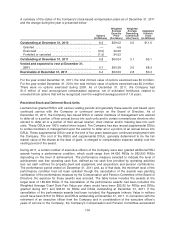

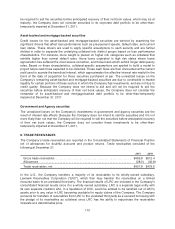

Liability Rollforward

The following table represents a rollforward of the liability incurred for employee termination benefits

and contract termination and lease charges in connection with the October 2009 Restructuring Plan. Of

the total $6.7 million restructuring liability, $2.8 million is included in Accrued liabilities and $3.9 million

is included in Other liabilities on the Company’s Consolidated Statements of Financial Position.

Employee

Termination

Benefits

Contract

Termination &

Lease Charges Total

Balance at January 1, 2009 .............................. $ — $ — $ —

Costs incurred ....................................... 51.5 1.0 52.5

Payments & Other (1) .................................. (1.5) — (1.5)

Reversals (2) ......................................... (0.1) — (0.1)

Balance at December 31, 2009 ........................... $49.9 $ 1.0 $ 50.9

Costs incurred ....................................... 6.2 4.9 11.1

Payments & Other (1) .................................. (27.3) (3.4) (30.7)

Reversals (2) ......................................... (4.6) (1.4) (6.0)

Balance at December 31, 2010 ........................... $24.2 $ 1.1 $ 25.3

Costs incurred ....................................... 0.9 0.4 1.3

Payments & Other (1) .................................. (16.3) (1.0) (17.3)

Reversals (2) ......................................... (2.1) (0.5) (2.6)

Balance at December 31, 2011 ........................... $ 6.7 $ — $ 6.7

(1) Other consists of changes in the liability balance due to foreign currency translations.

(2) Reversals due to changes in estimates for employee termination benefits.

Summary of Other Restructuring Actions

General

In response to global economic weakening, to enhance the efficiency of the Company’s inkjet cartridge

manufacturing operations and to reduce the Company’s business support cost and expense structure,

the Company announced various restructuring actions (“Other Restructuring Actions”) from 2006 to

April 2009. The Other Restructuring Actions include the closure of inkjet supplies manufacturing

facilities in Mexico as well as impacting positions in the Company’s general and administrative

functions, supply chain and sales support, marketing and sales management, and consolidation of the

Company’s research and development programs. The Other Restructuring Actions are considered

substantially completed and any remaining charges to be incurred from these actions are expected to

be immaterial.

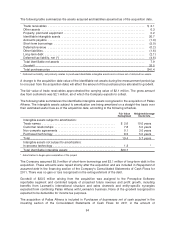

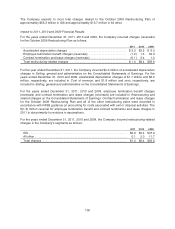

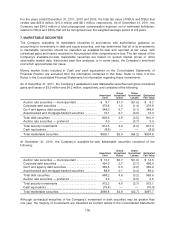

Impact to 2011, 2010 and 2009 Financial Results

For the years ended December 31, 2011, 2010 and 2009, the Company incurred charges (reversals)

for the Company’s Other Restructuring Actions as follows:

2011 2010 2009

Accelerated depreciation charges ..................................... $0.1 $ 2.4 $35.3

Impairment of long-lived assets held for sale ............................ 4.6 — —

Employee termination benefit charges (reversals) ........................ 0.2 (1.6) 16.8

Contract termination and lease charges (reversals) ....................... — (0.9) 0.4

Total restructuring-related charges (reversals) ........................... $4.9 $(0.1) $52.5

For the year ended December 31, 2011, accelerated depreciation charges of $0.1 million are included

in Selling, general and administrative on the Consolidated Statements of Earnings. For the years

ended December 31, 2010 and 2009, accelerated depreciation charges of $2.4 million and $35.2

million, respectively, are included in Cost of revenue, and zero and $0.1 million, respectively, are

included in Selling, general and administrative on the Consolidated Statements of Earnings.

101