Lexmark 2011 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2011 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.accordance with the guidance on accounting for the impairment or disposal of long-lived assets, the

building and land with a carrying value of $4 million ($3 million in previous periods due to foreign

currency translation) were written down to their fair value less cost to sell of $3 million, resulting in a

loss of $1 million for the year ended December 31, 2011. The loss is included in Selling, general and

administrative on the Consolidated Statements of Earnings. Fair value was estimated using a market

approach, based on available data for transactions in the region as well as the asking price of a

comparable property. The decrease in fair value during the first quarter of 2011 was driven by the

worsening of the industrial market in Juarez. Subsequent to the recognition of the loss during the first

quarter of 2011, the Company received an offer to purchase the facility comparable to the estimated

fair value. The Company completed the sale in the third quarter of 2011. Total proceeds from the sale

were $3.0 million, which resulted in a $0.6 million pre-tax gain recognized in Selling, general and

administrative on the Consolidated Statements of Earnings in the third quarter of 2011.

Related to the 2007 restructuring plan, the Company’s Orleans, France facility qualified as held for sale

in the second quarter of 2009. The carrying value of the building and land held for sale was

approximately $7 million at September 30, 2011. Due to certain developments subsequent to the time

the facility qualified as held for sale, negotiations with a potential buyer ceased in the fourth quarter of

2011. As a result the facility was written down to fair value less cost to sell of $3 million, resulting in a

loss of $4 million included in Selling, general and administrative on the Company’s Consolidated

Statements of Earnings for the year ended December 31, 2011. Fair value was estimated using an

income approach considering, from a market participant standpoint, discounted cash flows associated

with developing, leasing and ultimately selling the facility. The facility is included in Property, plant and

equipment, net on the Consolidated Statements of Financial Position. The Company is actively

marketing the facility for sale and is taking steps to minimize recurring expenses associated with the

facility. The Company received a $0.7 million payment in the fourth quarter of 2011 pursuant to a letter

of commitment signed in the first quarter of 2010 that obligated the potential buyer to 10% of the $7

million sale price.

Land held by the Company in Tatabanya, Hungary with a carrying value of $2 million was written down

to fair value less cost to sell of $1 million during the second quarter of 2011 due to the Company’s

receipt of an offer to purchase the land that was less than the carrying value of the land. The $1 million

loss is included in Selling, general and administrative on the Consolidated Statements of Earnings for

the year ended December 31, 2011. The Company completed the sale in the third quarter of 2011.

Total proceeds from the sale were $1.3 million. No gain or loss was realized on the sale in the third

quarter of 2011.

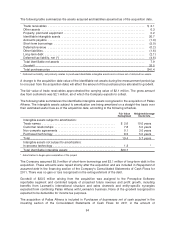

4. BUSINESS COMBINATIONS

Acquisition of Pallas Athena Holdings B.V.

On October 18, 2011, the Company acquired all issued and outstanding shares in Pallas Athena

Holdings B. V. (“Pallas Athena”) in a cash transaction valued at approximately $50.2 million. Pallas

Athena is a leading provider of BPM, document output management and process mining software

capabilities. The acquisition allows the Company to further strengthen its fleet management solutions

and services with a broader range of workflow solutions. The acquisition also will enable the

Company’s Perceptive Software segment to expand its presence in EMEA, while concurrently

leveraging the Company’s growing worldwide sales force to sell these software solutions globally.

Of the $50.2 million total cash payment, $41.4 million was paid to acquire the outstanding shares of

Pallas Athena, $7.1 million was used to repay debt and short-term borrowings, $1.2 million was used to

pay seller transaction fees, and $0.5 million was used to repay other obligations of Pallas Athena.

93