Lexmark 2010 Annual Report Download - page 93

Download and view the complete annual report

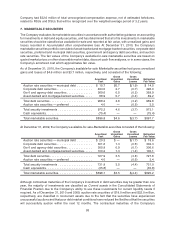

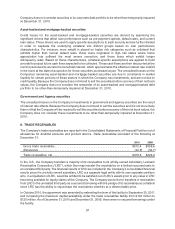

Please find page 93 of the 2010 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.where the customer relationships no longer exist immediately following the acquisition and must be re-

created.

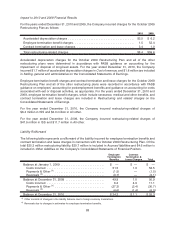

Developed technology was valued using the excess earnings method under the income approach, which

estimates the value of the intangible asset by calculating the present value of the incremental after-tax

cash flows, or excess earnings, attributable solely to the developed technology over its useful life. After-tax

cash flows were calculated by applying cost, expense, income tax, and contributory asset charge

assumptions to the estimated developed technology revenue streams. Contributory asset charges

included net working capital, net fixed assets, assembled workforce, trade name and trademarks,

customer relationships, and non-compete agreements. The analysis was performed over a nine year

technology migration period.

Trade name and trademarks were valued using the relief from royalty method under the income approach,

which estimates the value of the intangible asset by discounting to fair value the hypothetical royalty

payments a market participant would be willing to pay to enjoy the benefits of the asset. A royalty rate of 2%

was used in the valuation which took into account data regarding third party license agreements as well as

certain characteristics of Perceptive Software and its operations.

The after-tax cash flows for the intangible assets discussed directly above were discounted to fair value

utilizing a required return of 14%.

The fair value of deferred revenue was determined based on the direct and incremental costs to fulfill the

performance obligation plus a profit mark-up of 10% reflecting market participant assumptions.

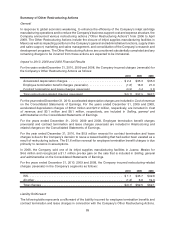

Other Acquisitions

On March 29, 2010 the Company acquired certain assets and rights of a privately held company for

$6.7 million cash consideration. The acquired group consisted mostly of technology and other related

assets and processes to be utilized in the Company’s ISS segment.

On January 1, 2009, the Company completed a step acquisition of a wholesaler with an established

presence in Eastern Europe and an existing customer base of wholesale distributors. Final cash

consideration given was approximately $11 million, or $10.1 million net of cash acquired.

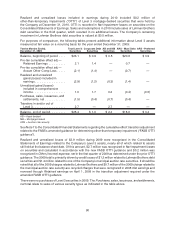

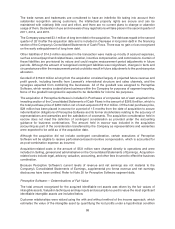

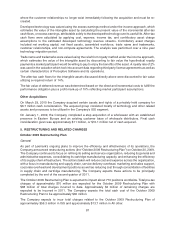

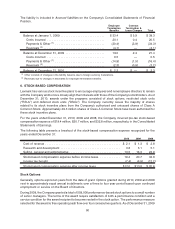

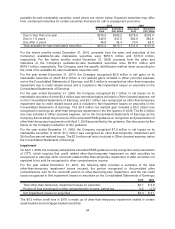

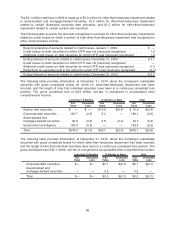

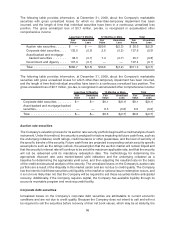

5. RESTRUCTURING AND RELATED CHARGES

October 2009 Restructuring Plan

General

As part of Lexmark’s ongoing plans to improve the efficiency and effectiveness of its operations, the

Company announced restructuring actions (the “October 2009 Restructuring Plan”) on October 20, 2009.

The Company continues its focus on refining its selling and service organization, reducing its general and

administrative expenses, consolidating its cartridge manufacturing capacity, and enhancing the efficiency

of its supply chain infrastructure. The actions taken will reduce cost and expense across the organization,

with a focus in manufacturing and supply chain, service delivery overhead, marketing and sales support,

corporate overhead and development positions as well as reducing cost through consolidation of facilities

in supply chain and cartridge manufacturing. The Company expects these actions to be principally

completed by the end of the second quarter of 2011.

The October 2009 Restructuring Plan is expected to impact about 770 positions worldwide. Total pre-tax

charges of approximately $70 million are expected for the October 2009 Restructuring Plan with

$68 million of total charges incurred to date. Approximately $2 million of remaining charges are

expected to be incurred in 2011. The Company expects the total cash cost of the October 2009

Restructuring Plan to be approximately $60 million.

The Company expects to incur total charges related to the October 2009 Restructuring Plan of

approximately $56.3 million in ISS and approximately $13.7 million in All other.

87