Lexmark 2010 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2010 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

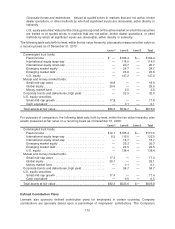

Corporate bonds and debentures: Valued at quoted prices in markets that are not active, broker

dealer quotations, or other methods by which all significant inputs are observable, either directly or

indirectly.

U.S. equity securities: Valued at the closing price reported on the active market on which the securities

are traded or at quoted prices in markets that are not active, broker dealer quotations, or other

methods by which all significant inputs are observable, either directly or indirectly.

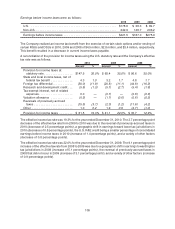

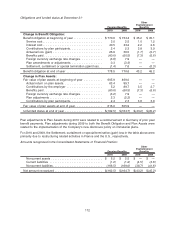

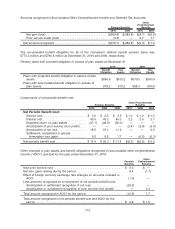

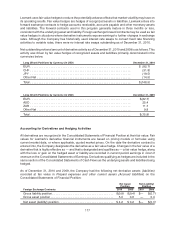

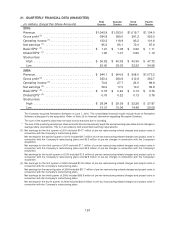

The following table sets forth by level, within the fair value hierarchy, plan assets measured at fair value on

a recurring basis as of December 31, 2010:

Level 1 Level 2 Level 3 Total

Commingled trust funds:

Fixed income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $184.4 $— $184.4

International equity large-cap . . . . . . . . . . . . . . . . . . . . . . . — 114.0 — 114.0

International equity small-cap . . . . . . . . . . . . . . . . . . . . . . . — 20.7 — 20.7

Emerging market equity . . . . . . . . . . . . . . . . . . . . . . . . . . . — 24.7 — 24.7

Emerging market debt. . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 23.6 — 23.6

U.S. equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 147.2 — 147.2

Mutual and money market funds:

Small mid-cap value . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18.9 — — 18.9

Global equity. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29.6 — — 29.6

Money market fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 2.5 — 2.5

Corporate bonds and debentures, high yield. . . . . . . . . . . . . . — 32.5 — 32.5

U.S. equity securities:

Small mid-cap growth . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17.8 — — 17.8

Cash equivalent . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 0.1 — 0.1

Total assets at fair value. . . . . . . . . . . . . . . . . . . . . . . . . . . . . $66.3 $549.7 $— $616.0

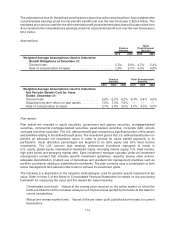

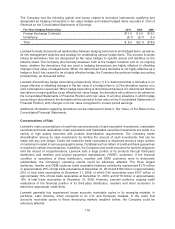

For purposes of comparison, the following table sets forth by level, within the fair value hierarchy, plan

assets measured at fair value on a recurring basis as of December 31, 2009:

Level 1 Level 2 Level 3 Total

Commingled trust funds:

Fixed income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $12.1 $165.4 $— $177.5

International equity large-cap . . . . . . . . . . . . . . . . . . . . . . . 6.5 116.0 — 122.5

International equity small-cap . . . . . . . . . . . . . . . . . . . . . . . — 18.7 — 18.7

Emerging market equity . . . . . . . . . . . . . . . . . . . . . . . . . . . — 25.3 — 25.3

Emerging market debt. . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 24.5 — 24.5

U.S. equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 138.4 — 138.4

Mutual and money market funds:

Small mid-cap value . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17.2 — — 17.2

Global equity. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29.1 — — 29.1

Money market fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 0.1 — 0.1

Corporate bonds and debentures, high yield. . . . . . . . . . . . . . — 34.7 — 34.7

U.S. equity securities:

Small mid-cap growth . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17.4 — — 17.4

Cash equivalent . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 0.5 — 0.5

Total assets at fair value. . . . . . . . . . . . . . . . . . . . . . . . . . . . . $82.3 $523.6 $— $605.9

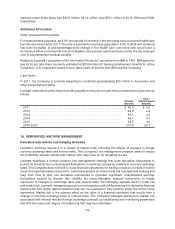

Defined Contribution Plans

Lexmark also sponsors defined contribution plans for employees in certain countries. Company

contributions are generally based upon a percentage of employees’ contributions. The Company’s

115