Lexmark 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.in the future due to the integration of Perceptive Software and anticipated growth of its business. The

Company plans to adopt the amendments of ASU 2009-13 and ASU 2009-14 on a prospective basis in the

first quarter of 2011.

In April 2010, the FASB issued ASU No. 2010-13, Compensation — Stock Compensation (Topic 718):

Effect of Denominating the Exercise Price of a Share-Based Payment Award in the Currency of the Market

in Which the Underlying Equity Security Trades (“ASU 2010-13”). ASU 2010-13 clarifies that employee

share-based awards with an exercise price denominated in the currency of a market in which a substantial

portion of the underlying equity trades would be eligible for equity classification even if the currency in

which the underlying equity trades is different from the functional currency of the employer entity or payroll

currency of the employee. The amendments will be effective for the Company in the first quarter of 2011

and must be applied by recording a cumulative-effect adjustment to opening balance retained earnings

calculated for all awards outstanding. ASU 2010-13 confirms the Company’s current accounting practices

and, therefore, has no impact to the financial statements.

The FASB also issued several accounting standards updates during 2010, not discussed above, that

related to technical corrections of existing guidance or new guidance that is not meaningful to the

Company’s current financial statements and disclosures.

Reclassifications:

Certain prior year amounts have been reclassified, if applicable, to conform to the current presentation.

Reclassifications include the separate presentation of Goodwill and Intangible assets, net, formerly

included in Other assets on the Consolidated Statements of Financial Position, due to increased levels

of these assets in 2010 as well as adjustments to segment data disclosures driven by the changes in the

Company’s reportable segments in 2010.

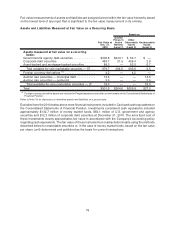

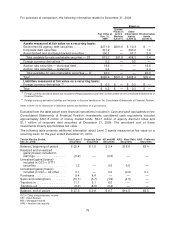

3. FAIR VALUE

General

The accounting guidance for fair value measurements defines fair value, establishes a framework for

measuring fair value in accordance with generally accepted accounting principles (“GAAP”), and requires

disclosures about fair value measurements. The guidance defines fair value as the price that would be

received to sell an asset or paid to transfer a liability in an orderly transaction between market participants

at the measurement date. As part of the framework for measuring fair value, the guidance establishes a

hierarchy of inputs to valuation techniques used in measuring fair value that maximizes the use of

observable inputs and minimizes the use of unobservable inputs by requiring that the most observable

inputs be used when available.

See Note 2 for information regarding recently issued fair value disclosure guidance by the Financial

Accounting Standards Board (“FASB”) that has been incorporated into the Notes to the Consolidated

Financial Statements.

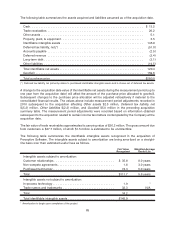

Fair Value Hierarchy

The three levels of the fair value hierarchy are:

• Level 1 — Quoted prices (unadjusted) in active markets for identical, unrestricted assets or

liabilities that the Company has the ability to access at the measurement date;

• Level 2 — Inputs other than quoted prices included in Level 1 that are observable for the asset or

liability, either directly or indirectly; and

• Level 3 — Unobservable inputs used in valuations in which there is little market activity for the asset

or liability at the measurement date.

77