Lexmark 2010 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2010 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

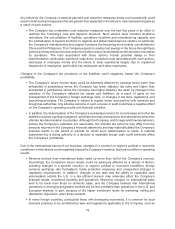

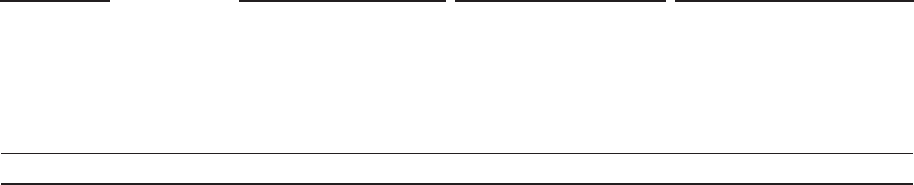

Equity Compensation Plan Information

The following table provides information about the Company’s equity compensation plans as of

December 31, 2010:

(Number of Securities in Millions)

Plan Category

Number of Securities to be

Issued Upon Exercise of

Outstanding Options,

Warrants and Rights

Weighted Average Exercise

Price of Outstanding

Options, Warrants and

Rights

(1)

Number of Securities

Remaining Available for Future

Issuance Under Equity

Compensation Plans

Equity compensation

plans approved by

stockholders . . . . . . . 9.7

(2)

$60.09 6.8

(3)

Equity compensation

plans not approved by

stockholders

(4)

. . . . . . 0.7 45.60 0.3

Total . . . . . . . . . . . . . . . 10.4 $59.02 7.1

(1) The numbers in this column represent the weighted average exercise price of stock options only.

(2) As of December 31, 2010, of the approximately 9.7 million awards outstanding under the equity compensation plans approved by

stockholders, there were approximately 7.7 million stock options (of which 7,400,000 are employee stock options and 307,000

are nonemployee director stock options), approximately 2.0 million restricted stock units (“RSUs”) and supplemental deferred

stock units (“DSUs”) (of which 1,865,000 are employee RSUs and supplemental DSUs and 94,000 are nonemployee director

RSUs), and 78,000 elective DSUs (of which 8,000 are employee elective DSUs and 70,000 are nonemployee director elective

DSUs) that pertain to voluntary elections by certain members of management to defer all or a portion of their annual incentive

compensation and by certain nonemployee directors to defer all or a portion of their annual retainer, chair retainer and/or meeting

fees, that would have otherwise been paid in cash.

(3) Of the 6.8 million shares available, 6.5 million relate to employee plans (of which 4.3 million may be granted as full-value awards)

and 0.3 million relate to the nonemployee director plan.

(4) As of December 31, 2010, Lexmark had only one equity compensation plan which had not been approved by its stockholders, the

Lexmark International, Inc. Broad-Based Employee Stock Incentive Plan (the “Broad-Based Plan”). The Broad-Based Plan,

which was established on December 19, 2000, provides for the issuance of up to 1.6 million shares of the Company’s common

stock pursuant to stock incentive awards (including stock options, stock appreciation rights, performance awards, RSUs and

DSUs) granted to the Company’s employees, other than its directors and executive officers. The Broad-Based Plan expressly

provides that the Company’s directors and executive officers are not eligible to participate in the Plan. The Broad-Based Plan

limits the number of shares subject to full-value awards (e.g., restricted stock units and performance awards) to 50,000 shares.

On February 24, 2011, the Company’s Board of Directors terminated the Broad-Based Plan and cancelled the remaining

available shares that had been authorized for issuance under the Plan. As of such date, approximately 192,000 shares remained

outstanding under the Broad-Based Plan (of which approximately 148,000 are in the form of stock options and 44,000 are in the

form of RSUs).

(5) RSUs granted in 2010 were included at the target level of achievement. Refer to Part II, Item 8, Note 6 for more information.

25