Lexmark 2010 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2010 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

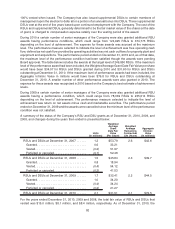

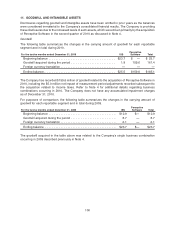

The $3.1 million credit loss in 2009 is made up of $0.6 million for other-than-temporary impairment related

to asset-backed and mortgage-backed securities, $1.2 million for other-than-temporary impairment

related to certain distressed corporate debt securities, and $1.3 million for other-than-temporary

impairment related to certain auction rate securities.

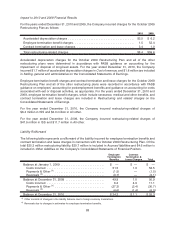

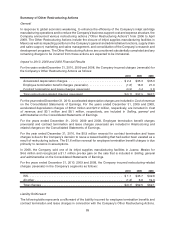

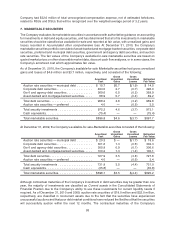

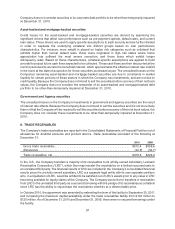

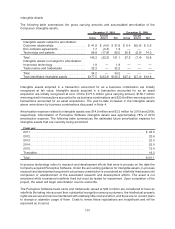

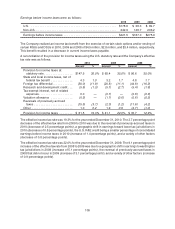

The following table presents the amounts recognized in earnings for other-than-temporary impairments

related to credit losses for which a portion of total other-than-temporary impairment was recognized in

other comprehensive income:

Beginning balance of amounts related to credit losses, January 1, 2009 . . . . . . . . . . . . . . . . $ —

Credit losses on debt securities for which OTTI was not previously recognized . . . . . . . . . . . 1.2

Additional credit losses on debt securities for which OTTI was previously recognized. . . . . . . 1.9

Ending balance of amounts related to credit losses, December 31, 2009 . . . . . . . . . . . . . . . . $ 3.1

Credit losses on debt securities for which OTTI was not previously recognized . . . . . . . . . . . —

Additional credit losses on debt securities for which OTTI was previously recognized. . . . . . . 0.3

Reductions for securities sold in the period for which OTTI was previously recognized . . . . . . (0.7)

Ending balance of amounts related to credit losses, December 31, 2010 . . . . . . . . . . . . . . . . $ 2.7

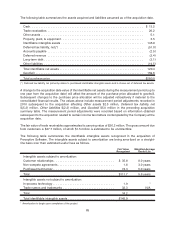

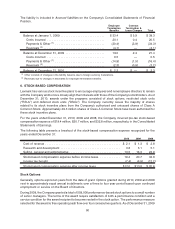

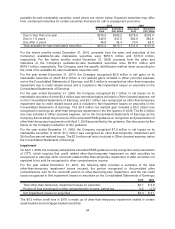

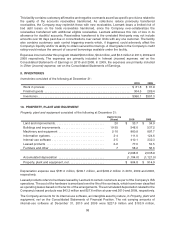

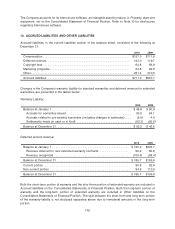

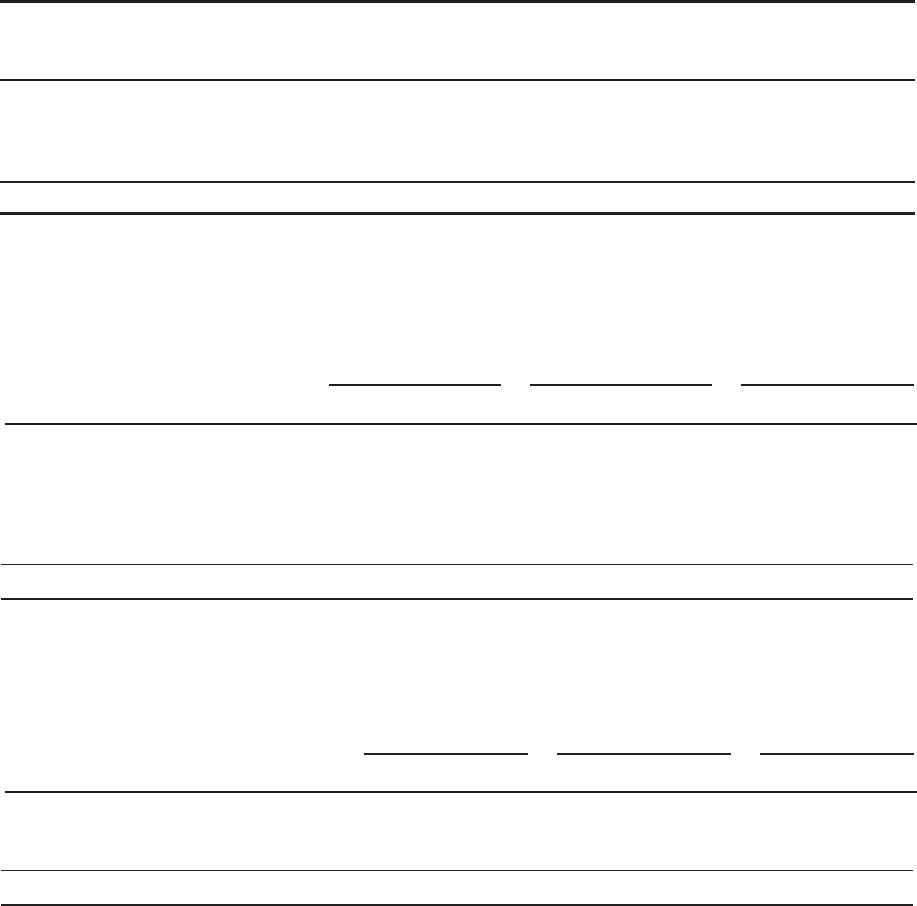

The following table provides information, at December 31, 2010, about the Company’s marketable

securities with gross unrealized losses for which no other-than-temporary impairment has been

incurred, and the length of time that individual securities have been in a continuous unrealized loss

position. The gross unrealized loss of $3.6 million, pre-tax, is recognized in accumulated other

comprehensive income:

Fair

Value

Unrealized

Loss

Fair

Value

Unrealized

Loss

Fair

Value

Unrealized

Loss

Less than 12 Months 12 Months or More Total

Auction rate securities . . . . . . . . $ — $ — $15.9 $(2.4) $ 15.9 $(2.4)

Corporate debt securities . . . . . 183.7 (0.6) 5.4 — 189.1 (0.6)

Asset-backed and

mortgage-backed securities. . . . 30.9 (0.2) 3.8 (0.2) 34.7 (0.4)

Government and Agency. . . . . . 163.4 (0.2) — — 163.4 (0.2)

Total . . . . . . . . . . . . . . . . . . . . . $378.0 $(1.0) $25.1 $(2.6) $403.1 $(3.6)

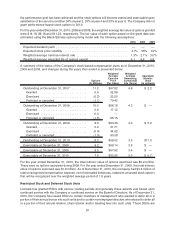

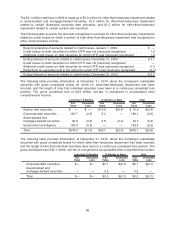

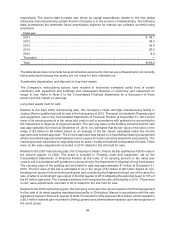

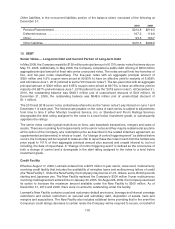

The following table provides information, at December 31, 2010, about the Company’s marketable

securities with gross unrealized losses for which other-than-temporary impairment has been incurred,

and the length of time that individual securities have been in a continuous unrealized loss position. The

gross unrealized loss of $0.1 million, pre-tax, is recognized in accumulated other comprehensive income:

Fair

Value

Unrealized

Loss

Fair

Value

Unrealized

Loss

Fair

Value

Unrealized

Loss

Less than 12 Months 12 Months or More Total

Corporate debt securities . . . . . . . $— $— $0.1 $(0.1) $0.1 $(0.1)

Asset-backed and

mortgage-backed securities . . . . . — — 0.2 — 0.2 —

Total . . . . . . . . . . . . . . . . . . . . . . $— $— $0.3 $(0.1) $0.3 $(0.1)

95