Lexmark 2010 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2010 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

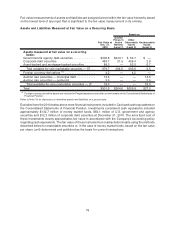

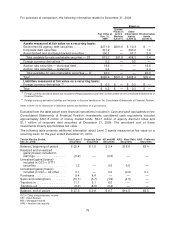

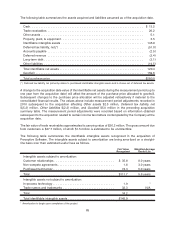

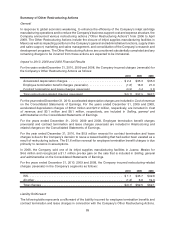

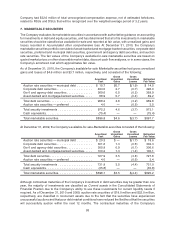

The following table summarizes the assets acquired and liabilities assumed as of the acquisition date.

Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 13.2

Trade receivables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26.2

Other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.1

Property, plant, & equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.5

Identifiable intangible assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 145.9

Deferred tax liability, net(*) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (51.0)

Accounts payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2.5)

Deferred revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2.4)

Long-term debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3.1)

Other liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (14.5)

Total identifiable net assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 120.4

Goodwill . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 159.6

Total purchase price . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $280.0

(*) Deferred tax liability, net primarily relates to purchased identifiable intangible assets and is shown net of deferred tax assets.

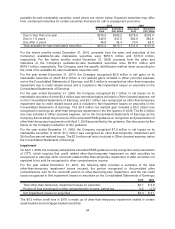

A change to the acquisition date value of the identifiable net assets during the measurement period (up to

one year from the acquisition date) will affect the amount of the purchase price allocated to goodwill.

Subsequent changes to the purchase price allocation will be adjusted retroactively if material to the

consolidated financial results. The values above include measurement period adjustments recorded in

2010 subsequent to the acquisition affecting Other assets $2.5 million, Deferred tax liability, net

$(5.2) million, Other liabilities $(2.3) million, and Goodwill $5.0 million in the preceding acquisition

summary table. The measurement period adjustments were recorded based on information obtained

subsequent to the acquisition related to certain income tax matters contemplated by the Company at the

acquisition date.

The fair value of trade receivables approximates its carrying value of $26.2 million. The gross amount due

from customers is $27.7 million, of which $1.5 million is estimated to be uncollectible.

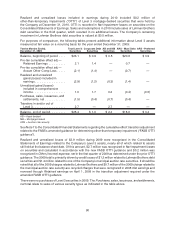

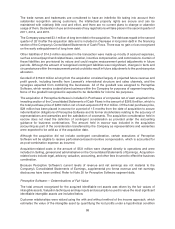

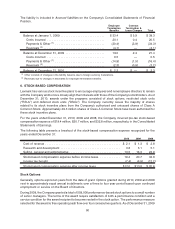

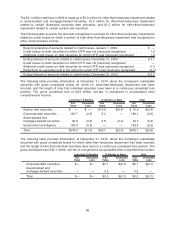

The following table summarizes the identifiable intangible assets recognized in the acquisition of

Perceptive Software. The intangible assets subject to amortization are being amortized on a straight-

line basis over their estimated useful lives as follows.

Fair Value

Recognized

Weighted-Average

Useful Life

Intangible assets subject to amortization:

Customer relationships . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 35.8 8.0 years

Non-compete agreements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.6 3.0 years

Purchased technology. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 74.3 5.0 years

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $111.7 5.9 years

Intangible assets not subject to amortization:

In-process technology . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.9 *

Trade names and trademarks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32.3 N/A

Total................................................. 34.2

Total identifiable intangible assets . . . . . . . . . . . . . . . . . . . . . . . . . . . $145.9

* Amortization to begin upon completion of the project

85