Lexmark 2010 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2010 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

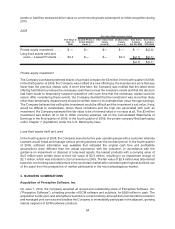

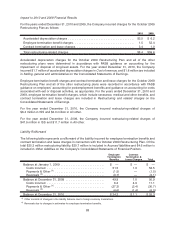

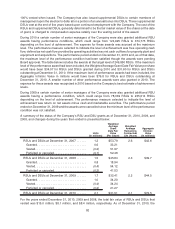

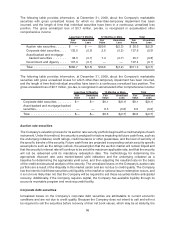

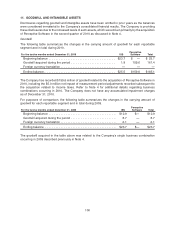

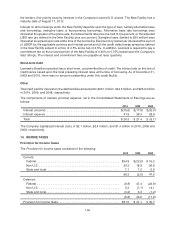

available-for-sale marketable securities noted above are shown below. Expected maturities may differ

from contractual maturities for certain securities that allow for call or prepayment provisions.

Amortized

Cost

Estimated

Fair Value

Amortized

Cost

Estimated

Fair Value

2010 2009

Due in less than one year . . . . . . . . . . . . . . . . . . . . . $279.9 $280.2 $278.9 $279.4

Due in 1-5 years . . . . . . . . . . . . . . . . . . . . . . . . . . . . 645.5 647.5 382.6 383.6

Due after 5 years . . . . . . . . . . . . . . . . . . . . . . . . . . . 46.8 45.4 70.4 68.0

Total available-for-sale marketable securities . . . . . . . $972.2 $973.1 $731.9 $731.0

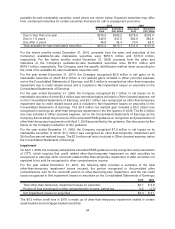

For the twelve months ended December 31, 2010, proceeds from the sales and maturities of the

Company’s available-for-sale marketable securities were $957.5 million and $174.8 million,

respectively. For the twelve months ended December 31, 2009, proceeds from the sales and

maturities of the Company’s available-for-sale marketable securities were $215.0 million and

$679.7 million, respectively. The Company uses the specific identification method when accounting for

the costs of its available-for-sale marketable securities sold.

For the year ended December 31, 2010, the Company recognized $2.9 million in net gains on its

marketable securities of which $3.2 million is net realized gains included in Other (income) expense,

net on the Consolidated Statements of Earnings, and $0.3 million is recognized as other-than-temporary

impairment due to credit related losses and is included in Net impairment losses on securities on the

Consolidated Statements of Earnings.

For the year ended December 31, 2009, the Company recognized $2.7 million in net losses on its

marketable securities of which $0.4 million was net realized gains included in Other (income) expense, net

on the Consolidated Statements of Earnings, and $3.1 million was recognized as other-than-temporary

impairment due to credit related losses and is included in Net impairment losses on securities on the

Consolidated Statements of Earnings. The $0.4 million net realized gain included a $0.2 million loss

recognized in earnings as other-than-temporary impairment in the first quarter of 2009. The $0.2 million

loss was included in Other (income) expense, net on the Consolidated Statements of Earnings as the

Company did not adopt the provisions of the amended FASB guidance on recognition and presentation of

other-than-temporary impairments until April 1, 2009 as permitted by the guidance. See discussion further

below on the Company’s adoption of this guidance.

For the year ended December 31, 2008, the Company recognized $7.9 million in net losses on its

marketable securities of which $7.3 million was recognized as other-than-temporary impairment and

$0.6 million was net realized losses. The $7.9 million net loss is included in Other (income) expense, net on

the Consolidated Statements of Earnings.

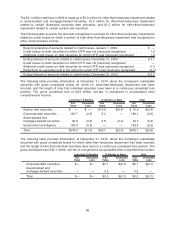

Impairment

On April 1, 2009, the Company adopted the amended FASB guidance on the recognition and presentation

of OTTI, which requires that credit related other-than-temporary impairment on debt securities be

recognized in earnings while noncredit related other-than-temporary impairment of debt securities not

expected to be sold be recognized in other comprehensive income.

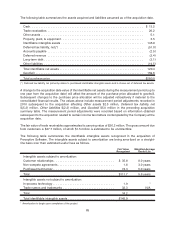

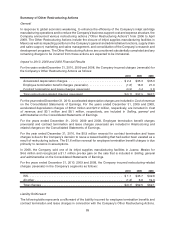

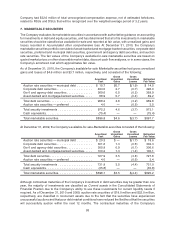

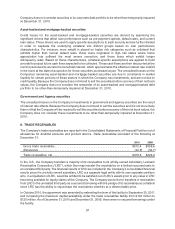

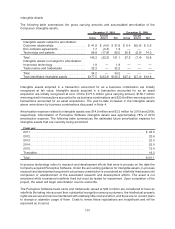

For the year ended December 31, 2010, the following table provides a summary of the total

other-than-temporary impairment losses incurred, the portion recognized in Accumulated other

comprehensive loss for the noncredit portion of other-than-temporary impairment, and the net credit

losses recognized in Net impairment losses on securities on the Consolidated Statements of Earnings:

2010 2009

Total other-than-temporary impairment losses on securities . . . . . . . . . . . . . . . . . . . . $0.1 $ 4.6

Portion of loss recognized in other comprehensive income, before tax . . . . . . . . . . . . 0.2 (1.5)

Net impairment losses on securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $0.3 $ 3.1

The $0.3 million credit loss in 2010 is made up of other-than-temporary impairment related to certain

asset-backed and mortgage-backed securities.

94