Lexmark 2010 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2010 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

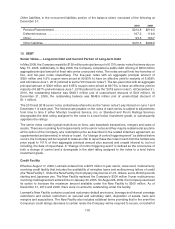

the lenders, first priority security interests in the Company’s owned U.S. assets. The New Facility has a

maturity date of August 17, 2012.

Interest on all borrowings under the New Facility depends upon the type of loan, namely alternative base

rate borrowings, swingline loans or eurocurrency borrowings. Alternative base rate borrowings bear

interest at the greater of the prime rate, the federal funds rate plus one-half of one percent, or the adjusted

LIBO rate (as defined in the New Facility) plus one percent. Swingline loans (limited to $50 million) bear

interest at an agreed upon rate at the time of the borrowing. Eurocurrency loans bear interest at the sum of

(i) LIBOR for the applicable currency and interest period and (ii) the credit default swap spread as defined

in the New Facility subject to a floor of 2.5% and a cap of 4.5%. In addition, Lexmark is required to pay a

commitment fee on the unused portion of the New Facility of 0.40% to 0.75% based upon the Company’s

debt ratings. The interest and commitment fees are payable at least quarterly.

Short-term Debt

Lexmark’s Brazilian operation has a short-term, uncommitted line of credit. The interest rate on this line of

credit varies based upon the local prevailing interest rates at the time of borrowing. As of December 31,

2009 and 2010, there was no amount outstanding under this credit facility.

Other

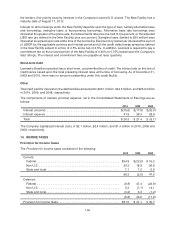

Total cash paid for interest on the debt facilities amounted to $43.1 million, $42.5 million, and $26.9 million

in 2010, 2009, and 2008, respectively.

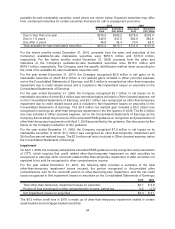

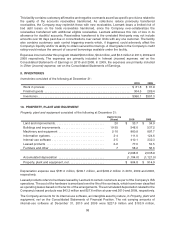

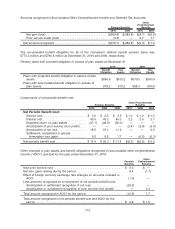

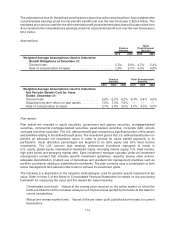

The components of Interest (income) expense, net in the Consolidated Statements of Earnings are as

follows:

2010 2009 2008

Interest (income) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(15.6) $(17.9) $(35.0)

Interest expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41.9 39.3 28.9

Total.................................................... $26.3 $21.4 $ (6.1)

The Company capitalized interest costs of $2.1 million, $3.4 million, and $1.4 million in 2010, 2009 and

2008, respectively.

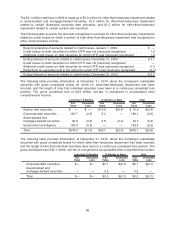

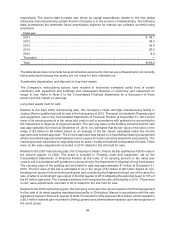

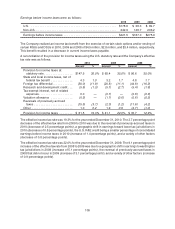

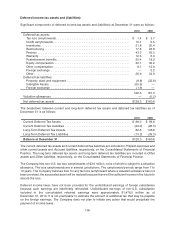

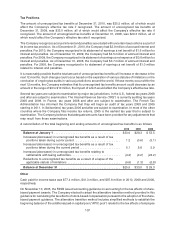

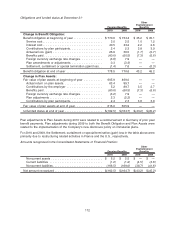

14. INCOME TAXES

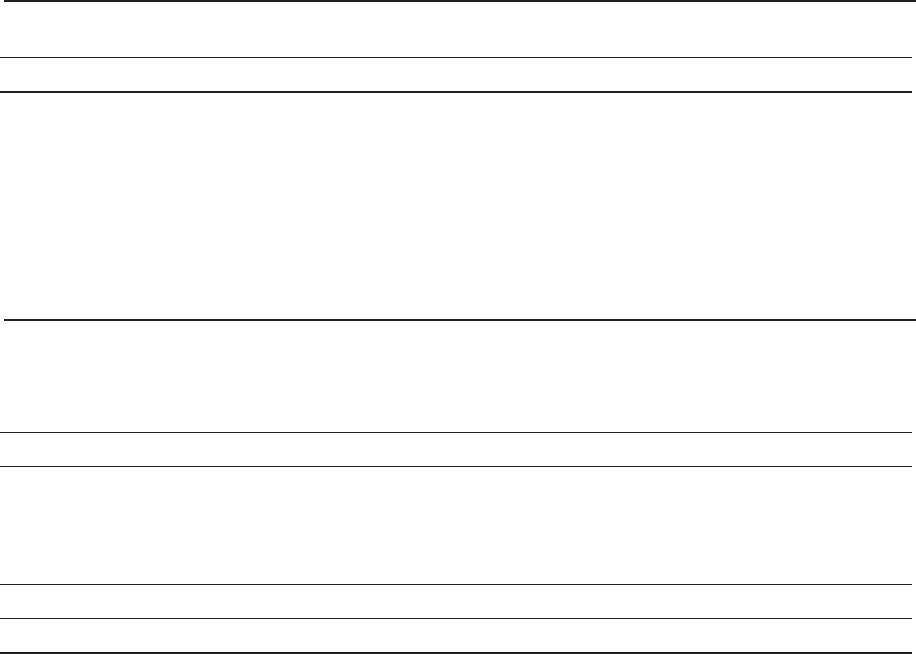

Provision for Income Taxes

The Provision for income taxes consisted of the following:

2010 2009 2008

Current:

Federal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $54.9 $(22.6) $ 15.2

Non-U.S. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26.3 18.9 26.8

State and local. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.1 1.2 5.6

88.3 (2.5) 47.6

Deferred:

Federal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (8.8) 47.4 (24.8)

Non-U.S. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.2 (7.1) 14.1

State and local. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3.2) 3.3 (1.2)

(6.8) 43.6 (11.9)

Provision for income taxes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $81.5 $ 41.1 $ 35.7

104