Lexmark 2010 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2010 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company assesses its marketable securities for other-than-temporary declines in value in

accordance with the model provided under the FASB’s amended guidance, which was adopted in the

second quarter of 2009. The Company has disclosed in the Critical Accounting Policies and Estimates

portion of Management’s Discussion and Analysis its policy regarding the factors it considers and

significant judgments made in applying the amended guidance. There were no major developments

during 2010 with respect to OTTI of the Company’s marketable securities. Specifically regarding the

Company’s auction rate securities, the most illiquid securities in the portfolio, Lexmark has previously

recognized OTTI on only one security due to credit events involving the issuer and the insurer. Because of

the Company’s liquidity position, it is not more likely than not that the Company will be required to sell the

auction rate securities until liquidity in the market or optional issuer redemption occurs. The Company

could also hold the securities to maturity if it chooses. Additionally, if Lexmark required capital, the

Company has available liquidity through its accounts receivable program and revolving credit facility. Given

these circumstances, the Company would only have to recognize OTTI on its auction rate securities if the

present value of the expected cash flows is less than the amortized cost of the individual security. There

have been no realized losses from the sale or redemption of auction rate securities.

The Company generally employs a market approach in valuing its marketable securities, using quoted

market prices or other observable market data when available. In certain instances, when observable

market data is lacking, fair values are determined using valuations techniques consistent with the income

approach whereby future cash flows are converted to a single discounted amount. The Company uses

multiple third parties to report the fair values of the securities in which Lexmark is invested, though the

responsibility of valuation remains with the Company’s management. Most of the securities’ fair values are

based upon a consensus price method, whereby prices from a variety of industry data providers are input

into a distribution-curve based algorithm to determine the most appropriate fair value. Starting in the first

quarter of 2010, the Company acquired access to additional sources of pricing, trading, and other market

data in order to enhance its process of corroborating fair values and testing default level assumptions. The

Company assesses the quantity of pricing sources available, variability in the prices provided, trading

activity, and other relevant data in performing this process.

Level 3 fair value measurements are based on inputs that are unobservable and significant to the overall

valuation. Level 3 measurements were roughly 3% of the Company’s total available-for-sale marketable

securities portfolio at December 31, 2010 compared to 4% at December 31, 2009.

Refer to Part II, Item 8, Note 3 of the Notes to Consolidated Financial Statements for additional information

regarding fair value measurements. Refer to Part II, Item 8, Note 7 of the Notes to Consolidated Financial

Statements for additional information regarding marketable securities.

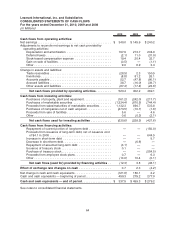

Capital expenditures

The Company invested $161.2 million, $242.0 million, and $217.7 million into Property, plant and

equipment for the years 2010, 2009 and 2008 respectively. Further discussion regarding 2010 capital

expenditures as well as anticipated spending for 2011 are provided near the end of Item 7.

Other notable investing activities

Proceeds from sale of facilities includes $5.6 million received from the sale of the Company’s inkjet

supplies manufacturing facility located in Chihuahua, Mexico in 2010 and $4.6 million received from the

sale of the Company’s inkjet supplies assembly plant located in Juarez, Mexico in 2008, both of which were

part of the Company’s restructuring actions.

Financing activities

The fluctuations in the net cash flows provided by (used for) financing activities were principally due to the

Company’s debt activity and share repurchases. In 2010, cash flows used for financing activities were

$12.3 million due mainly to the decrease in bank overdrafts of $10.0 million included in Other as well as the

$3.1 million repayment of long term debt that was assumed by the Company in the second quarter

55