Lexmark 2010 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2010 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

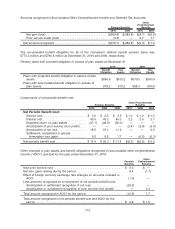

expense under these plans was $23.6 million, $21.4 million, and $25.1 million in 2010, 2009 and 2008,

respectively.

Additional Information

Other postretirement benefits:

For measurement purposes, an 8.0% annual rate of increase in the per capita cost of covered health care

benefits was assumed for 2011. The rate is assumed to decrease gradually to 4.5% in 2028 and remain at

that level thereafter. A one-percentage-point change in the health care cost trend rate would have a

de minimus effect on the benefit cost and obligation since preset caps have been met for the net employer

cost of postretirement medical benefits.

Related to Lexmark’s acquisition of the Information Products Corporation from IBM in 1991, IBM agreed to

pay for its pro rata share (currently estimated at $20.8 million) of future postretirement benefits for all the

Company’s U.S. employees based on pro rated years of service with IBM and the Company.

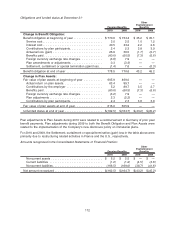

Cash flows:

In 2011, the Company is currently expecting to contribute approximately $35 million to its pension and

other postretirement plans.

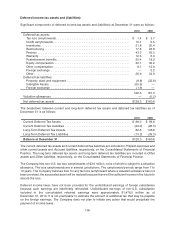

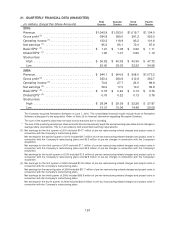

Lexmark estimates that the future benefits payable for the pension and other postretirement plans are as

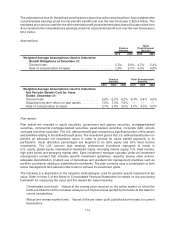

follows:

Pension

Benefits

Other

Postretirement

Benefits

2011 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 50.4 $ 4.5

2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49.9 4.4

2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 50.1 4.2

2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49.1 4.1

2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48.5 4.0

2016-2020 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 247.8 20.7

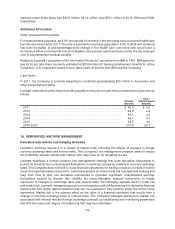

18. DERIVATIVES AND RISK MANAGEMENT

Derivative Instruments and Hedging Activities

Lexmark’s activities expose it to a variety of market risks, including the effects of changes in foreign

currency exchange rates and interest rates. The Company’s risk management program seeks to reduce

the potentially adverse effects that market risks may have on its operating results.

Lexmark maintains a foreign currency risk management strategy that uses derivative instruments to

protect its interests from unanticipated fluctuations in earnings caused by volatility in currency exchange

rates. The Company does not hold or issue financial instruments for trading purposes nor does it hold or

issue leveraged derivative instruments. Lexmark maintains an interest rate risk management strategy that

may, from time to time use derivative instruments to minimize significant, unanticipated earnings

fluctuations caused by interest rate volatility. By using derivative financial instruments to hedge

exposures to changes in exchange rates and interest rates, the Company exposes itself to credit risk

and market risk. Lexmark manages exposure to counterparty credit risk by entering into derivative financial

instruments with highly rated institutions that can be expected to fully perform under the terms of the

agreement. Market risk is the adverse effect on the value of a financial instrument that results from a

change in currency exchange rates or interest rates. The Company manages exposure to market risk

associated with interest rate and foreign exchange contracts by establishing and monitoring parameters

that limit the types and degree of market risk that may be undertaken.

116