Lexmark 2010 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2010 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Research and Development Costs:

Lexmark engages in the design and development of new products and enhancements to its existing

products. The Company’s research and development activity is focused on laser and inkjet devices and

associated supplies, features and related technologies as well as software. The Company expenses

research and development costs when incurred. Research and development costs include salary and

labor expenses, infrastructure costs, and other costs leading to the establishment of technological

feasibility of the new product or enhancement.

Advertising Costs:

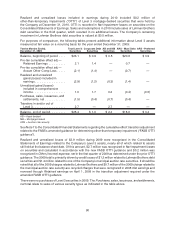

The Company expenses advertising costs when incurred. Advertising expense was approximately

$53.0 million, $51.5 million, and $93.4 million, in 2010, 2009 and 2008, respectively.

Pension and Other Postretirement Plans:

The Company accounts for its defined benefit pension and other postretirement plans using actuarial

models. Liabilities are computed using the projected unit credit method. The objective under this method is

to expense each participant’s benefits under the plan as they accrue, taking into consideration future

salary increases and the plan’s benefit allocation formula. Thus, the total pension to which each participant

is expected to become entitled is broken down into units, each associated with a year of past or future

credited service.

The discount rate assumption for the pension and other postretirement benefit plan liabilities reflects the

rates at which the benefits could effectively be settled and are based on current investment yields of high-

quality fixed-income investments. The Company uses a yield-curve approach to determine the assumed

discount rate based on the timing of the cash flows of the expected future benefit payments. This approach

matches the plan’s cash flows to that of a yield curve that provides the equivalent yields on zero-coupon

corporate bonds for each maturity.

The Company’s assumed long-term rate of return on plan assets is based on long-term historical actual

return information, the mix of investments that comprise plan assets, and future estimates of long-term

investment returns by reference to external sources. The Company also includes an additional return for

active management, when appropriate, and deducts various expenses. Differences between actual and

expected asset returns on equity and high yield investments are recognized in the calculation of net

periodic benefit cost over five years.

The rate of compensation increase is determined by the Company based upon its long-term plans for such

increases. Effective April 2006, this assumption is no longer applicable to the U.S. pension plan due to the

benefit accrual freeze in connection with the Company’s 2006 restructuring actions. Unrecognized

actuarial gains and losses that fall outside the “10% corridor” are amortized on a straight-line basis

over the remaining estimated service period of active participants. The Company has elected to continue

using the average remaining service period over which to amortize the unrecognized actuarial gains and

losses on the frozen U.S. plan.

The Company’s funding policy for its pension plans is to fund the minimum amounts according to the

regulatory requirements under which the plans operate. From time to time, the Company may choose to

fund amounts in excess of the minimum for various reasons.

The Company accrues for the cost of providing postretirement benefits such as medical and life insurance

coverage over the remaining estimated service period of participants. These benefits are funded by the

Company when paid.

The accounting guidance for employers’ defined benefit pension and other postretirement plans requires

recognition of the funded status of a benefit plan in the statement of financial position and recognition in

other comprehensive earnings of certain gains and losses that arise during the period, but are deferred

under pension accounting rules.

72