Lexmark 2010 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2010 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Lexmark also procures a wide variety of components used in the manufacturing process. Although many of

these components are available from multiple sources, the Company often utilizes preferred supplier

relationships to better ensure more consistent quality, cost and delivery. The Company also sources some

printer engines and finished products from OEMs. Typically, these preferred suppliers maintain alternate

processes and/or facilities to ensure continuity of supply. Although Lexmark plans in anticipation of its

future requirements, should these components not be available from any one of these suppliers, there can

be no assurance that production of certain of the Company’s products would not be disrupted.

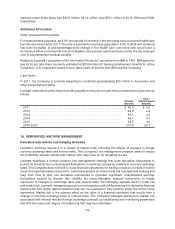

19. COMMITMENTS AND CONTINGENCIES

Commitments

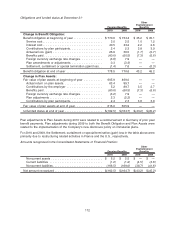

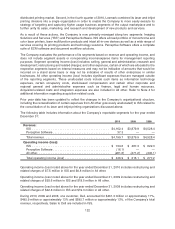

Lexmark is committed under operating leases (containing various renewal options) for rental of office and

manufacturing space and equipment. Rent expense (net of rental income) was $43.1 million, $48.3 million

and $55.6 million in 2010, 2009 and 2008, respectively. Future minimum rentals under terms of non-

cancelable operating leases (net of sublease rental income commitments) as of December 31, 2010, were

as follows:

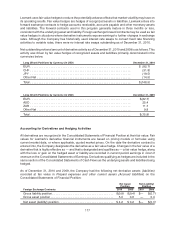

2011 2012 2013 2014 2015 Thereafter

Minimum lease payments (net of sublease

rental income) $30.0 $23.5 $16.4 $11.8 $9.0 $4.9

Contingencies

In accordance with FASB guidance on accounting for contingencies, Lexmark records a provision for a loss

contingency when management believes that it is both probable that a liability has been incurred and the

amount of loss can be reasonably estimated. The Company believes it has adequate provisions for any

such matters.

Legal proceedings

Lexmark v. Static Control Components, Inc. & Lexmark v. Clarity Imaging Technologies, Inc.

On December 30, 2002 (“02 action”) and March 16, 2004 (“04 action”), the Company filed claims against

Static Control Components, Inc. (“SCC”) in the U.S. District Court for the Eastern District of Kentucky (the

“District Court”) alleging violation of the Company’s intellectual property and state law rights. Similar claims

in a separate action were filed by the Company in the District Court against Clarity Imaging Technologies,

Inc. (“Clarity”) on October 8, 2004. SCC and Clarity have filed counterclaims against the Company in the

District Court alleging that the Company engaged in anti-competitive and monopolistic conduct and unfair

and deceptive trade practices in violation of the Sherman Act, the Lanham Act and state laws. SCC has

stated in its legal documents that it is seeking approximately $17.8 million to $19.5 million in damages for

the Company’s alleged anticompetitive conduct and approximately $1 billion for Lexmark’s alleged

violation of the Lanham Act. Clarity has not stated a damage dollar amount. SCC and Clarity are

seeking treble damages, attorney fees, costs and injunctive relief. On September 28, 2006, the District

Court dismissed the counterclaims filed by SCC that alleged the Company engaged in anti-competitive

and monopolistic conduct and unfair and deceptive trade practices in violation of the Sherman Act, the

Lanham Act and state laws. On October 13, 2006, SCC filed a Motion for Reconsideration of the District

Court’s Order dismissing SCC’s claims, or in the alternative, to amend its pleadings, which the District

Court denied on June 1, 2007. On June 20, 2007, the District Court Judge ruled that SCC directly infringed

one of Lexmark’s patents-in-suit. On June 22, 2007, the jury returned a verdict that SCC did not induce

infringement of Lexmark’s patents-in-suit. SCC has filed motions with the District Court seeking attorneys’

fees, cost and damages for the period that a preliminary injunction was in place that prevented SCC from

selling certain microchips for some models of the Company’s toner cartridges. The Company has

responded to these motions and they are pending with the District Court. Notice of Appeal of the 02

and 04 actions has been filed with the U.S. Court of Appeals for the Sixth Circuit.

119