Lexmark 2010 Annual Report Download - page 75

Download and view the complete annual report

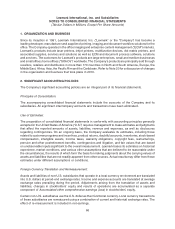

Please find page 75 of the 2010 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Property, Plant and Equipment:

Property, plant and equipment are stated at cost and depreciated over their estimated useful lives using the

straight-line method. The Company capitalizes interest related to the construction of certain fixed assets if

the effect of capitalization is deemed material. Property, plant and equipment accounts are relieved of the

cost and related accumulated depreciation when assets are disposed of or otherwise retired.

Internal-Use Software Costs:

Lexmark capitalizes direct costs incurred during the application development and implementation stages

for developing, purchasing, or otherwise acquiring software for internal use. These software costs are

included in Property, plant and equipment, net, on the Consolidated Statements of Financial Position and

are depreciated over the estimated useful life of the software, generally three to five years. All costs

incurred during the preliminary project stage are expensed as incurred.

Goodwill and Intangible Assets:

Lexmark assesses its goodwill and indefinite-lived intangible assets for impairment in the fourth quarter of

each fiscal year or between annual tests if an event occurs or circumstances change that lead

management to believe it is more likely than not that an impairment exists. Examples of such events

or circumstances include a significant adverse change in the business climate, a significant decrease in the

projected cash flows of a reporting unit, or a decline in the market capitalization of the overall Company

below its carrying value. The Company considers both a discounted cash flow analysis, which requires

judgments such as projected future earnings and weighted average cost of capital, as well as certain

market-based measurements, including multiples developed from trading stock prices and prices paid in

observed market transactions of comparable companies, in its estimation of fair value for goodwill

impairment testing. The Company estimates the fair value of its trade names and trademarks

indefinite-lived intangible asset using the relief from royalty method.

Intangible assets with finite lives are amortized over their estimated useful lives using the straight-line

method. In certain instances where consumption could be greater in the earlier years of the asset’s life, the

Company has selected, as a compensating measure, a shorter period over which to amortize the asset.

The Company’s intangible assets with finite lives are tested for impairment in accordance with its policy for

long-lived assets below.

Long-Lived Assets:

Lexmark performs reviews for the impairment of long-lived assets whenever events or changes in

circumstances indicate that the carrying amount of an asset may not be recoverable. If the estimated

undiscounted future cash flows expected to result from the use of the assets and their eventual disposition

are insufficient to recover the carrying value of the assets, then an impairment loss is recognized based

upon the excess of the carrying value of the assets over the fair value of the assets. Fair value is

determined based on the highest and best use of the assets considered from the perspective of market

participants.

Lexmark also reviews any legal and contractual obligations associated with the retirement of its long-lived

assets and records assets and liabilities, as necessary, related to such obligations. The asset recorded is

amortized over the useful life of the related long-lived tangible asset. The liability recorded is relieved when

the costs are incurred to retire the related long-lived tangible asset. The Company’s asset retirement

obligations are currently not material to the Company’s Consolidated Statements of Financial Position.

Financing Receivables:

The Company assesses and monitors credit risk associated with financing receivables, namely capital

lease receivables, through an analysis of both commercial risk and political risk associated with the

customer financing. Internal credit quality indicators are developed by the geographical unit contemplating

69