Lexmark 2010 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2010 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the customer financing, taking into account the customer’s net worth, payment history, long term debt

ratings and/or other information available from recognized credit rating services. If such information is not

available, the Company estimates a rating based on its analysis of the customer’s audited financial

statements prepared and certified in accordance with recognized generally accepted accounting

principles. The portfolio is assessed on an annual basis for significant changes in credit ratings or

other information indicating an increase in exposure to credit risk.

Environmental Remediation Obligations:

Lexmark accrues for losses associated with environmental remediation obligations when such losses are

probable and reasonably estimable. In the early stages of a remediation process, particular components of

the overall obligation may not be reasonably estimable. In this circumstance, the Company recognizes a

liability for the best estimate (or the minimum amount in a range if no best estimate is available) of the cost

of the remedial investigation-feasibility study, related consultant and external legal fees, and for any other

component remediation costs that can be reasonably estimated. Accruals are adjusted as further

information develops or circumstances change. Recoveries from other parties are recorded as assets

when their receipt is deemed probable.

Waste Obligation:

Waste Electrical and Electronic Equipment (“WEEE”) Directives issued by the European Union require

producers of electrical and electronic goods to be financially responsible for specified collection, recycling,

treatment and disposal of past and future covered products. The Company’s estimated liability for these

costs involves a number of uncertainties and takes into account certain assumptions and judgments

including average collection costs, return rates and product lives. The Company adjusts its liability, as

necessary, when a sufficient level of entity-specific experience indicates a change in estimate is warranted.

Warranty:

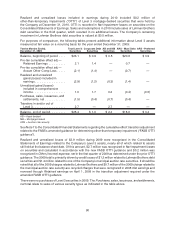

Lexmark provides for the estimated cost of product warranties at the time revenue is recognized. The

amounts accrued for product warranties are based on the quantity of units sold under warranty, estimated

product failure rates, and material usage and service delivery costs. The estimates for product failure rates

and material usage and service delivery costs are periodically adjusted based on actual results. For

extended warranty programs, the Company defers revenue in short-term and long-term liability accounts

(based on the extended warranty contractual period) for amounts invoiced to customers for these

programs and recognizes the revenue ratably over the contractual period. Costs associated with

extended warranty programs are expensed as incurred.

Shipping and Distribution Costs:

Lexmark includes shipping and distribution costs in Cost of Revenue on the Consolidated Statements of

Earnings.

Segment Data:

The Company is primarily managed along two segments: Imaging Solutions and Services (“ISS”) and

Perceptive Software. ISS offers a broad portfolio of monochrome and color laser printers, laser

multifunction products and inkjet all-in-one devices as well as a wide range of supplies and services

covering its printing products and technology solutions. Perceptive Software offers a complete suite of

enterprise content management software and document workflow solutions.

70