Lexmark 2010 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2010 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

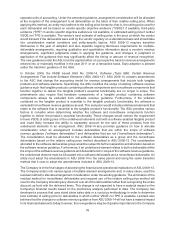

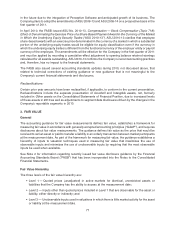

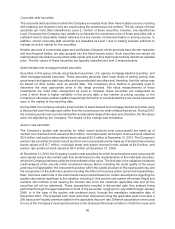

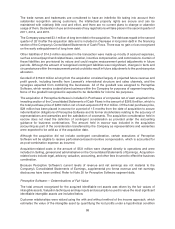

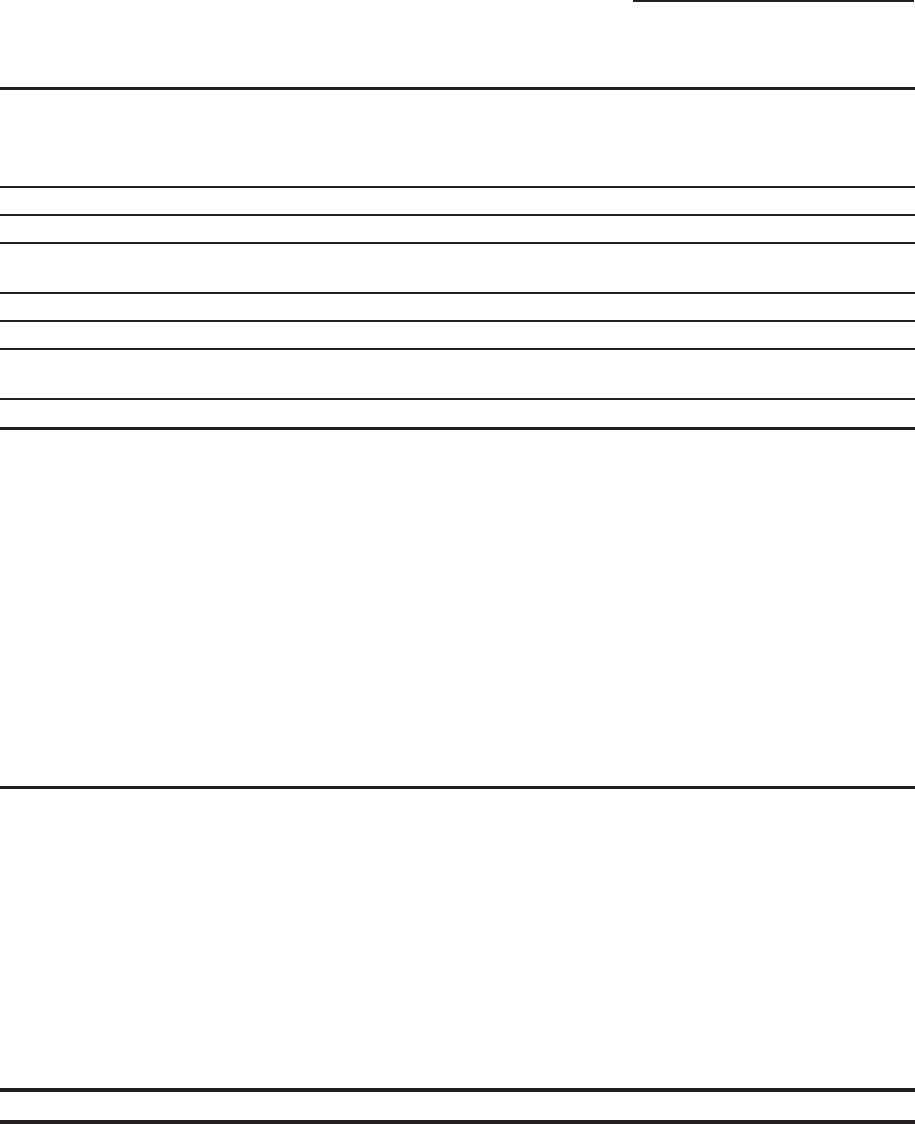

For purposes of comparison, the following information relates to December 31, 2009.

Fair Value at

Dec. 31,

2009

Quoted

Prices in

Active

Markets

(Level 1)

Other

Observable

Inputs

(Level 2)

Unobservable

Inputs

(Level 3)

Based on

Assets measured at fair value on a recurring basis:

Government & agency debt securities . . . . . . . . . . . . . $271.9 $261.6 $ 10.3 $ —

Corporate debt securities . . . . . . . . . . . . . . . . . . . . . . 301.2 — 300.2 1.0

Asset-backed and mortgage-backed securities . . . . . . 100.1 — 97.7 2.4

Total available-for-sale marketable securities — ST . . . 673.2 261.6 408.2 3.4

Foreign currency derivatives

(1)

.................. 0.2 — 0.2 —

Auction rate securities — municipal debt . . . . . . . . . . . 18.6 — — 18.6

Auction rate securities — preferred . . . . . . . . . . . . . . . 3.4 — — 3.4

Total available-for-sale marketable securities — LT . . 22.0 — — 22.0

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $695.4 $261.6 $408.4 $25.4

Liabilities measured at fair value on a recurring basis:

Foreign currency derivatives

(2)

.................. $ 0.3 $ — $ 0.3 $ —

Total ...................................... $ 0.3 $ — $ 0.3 $ —

(1)

Foreign currency derivative assets are included in Prepaid expenses and other current assets on the Consolidated Statements of

Financial Position.

(2)

Foreign currency derivative liabilities are included in Accrued liabilities on the Consolidated Statements of Financial Position.

Refer to Note 18 for disclosure of derivative assets and liabilities on a gross basis.

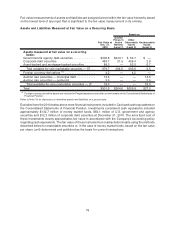

Excluded from the table above were financial instruments included in Cash and cash equivalents on the

Consolidated Statements of Financial Position. Investments considered cash equivalents included

approximately $301.8 million of money market funds, $34.7 million of agency discount notes and

$1.1 million of corporate debt securities at December 31, 2009. The amortized cost of these

investments closely approximates fair value.

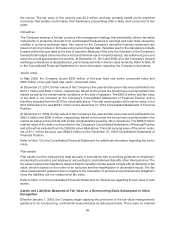

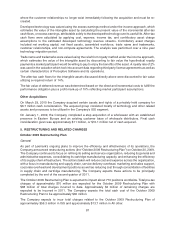

The following table presents additional information about Level 3 assets measured at fair value on a

recurring basis for the year ended December 31, 2010:

Twelve Months Ended,

Dec. 31, 2010

Total Level 3

Securities

Corporate Debt

Securities

AB and MB

Securities

ARS - Muni Debt

Securities

ARS - Preferred

Securities

Balance, beginning of period . . . . $ 25.4 $ 1.0 $ 2.4 $18.6 $3.4

Realized and unrealized

gains/(losses) included in

earnings.................. (0.2) — (0.2) — —

Unrealized gains/(losses)

included in OCI — OTTI

securities . . . . . . . . . . . . . . . . . 1.2 — 0.6 0.6 —

Unrealized gains/(losses)

included in OCI — All other. . . . 0.1 — 0.2 (0.2) 0.1

Purchases . . . . . . . . . . . . . . . . . . 8.4 8.4 — — —

Sales and redemptions . . . . . . . . (10.1) (3.7) (1.9) (4.5) —

Transfers in . . . . . . . . . . . . . . . . . 11.1 5.1 6.0 — —

Transfers out . . . . . . . . . . . . . . . . (8.4) (8.0) (0.4) — —

Balance, end of period . . . . . . . . . $ 27.5 $ 2.8 $ 6.7 $14.5 $3.5

OCI = Other comprehensive income

AB = Asset-backed

MB = Mortgage-backed

ARS = Auction rate security

79