Lexmark 2010 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2010 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

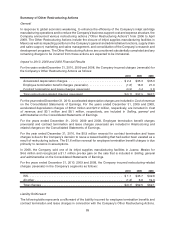

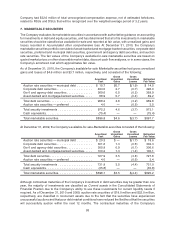

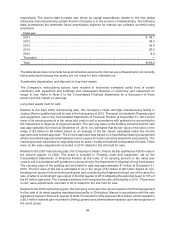

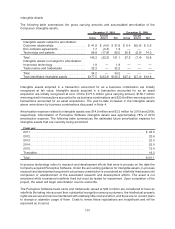

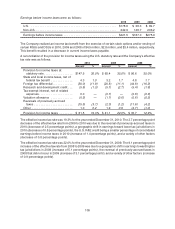

respectively. The year-to-date increase was driven by capital expenditures related to the new global

enterprise resource planning system that the Company is in the process of implementing. The following

table summarizes the estimated future amortization expense for internal-use software currently being

amortized.

Fiscal year:

2011 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 49.1

2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39.3

2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33.4

2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26.0

2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.4

Thereafter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . —

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $156.2

The table above does not include future amortization expense for internal-use software that is not currently

being amortized because the assets are not ready for their intended use.

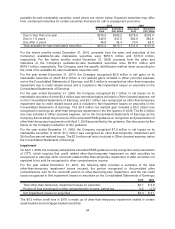

Accelerated depreciation and disposal of long-lived assets

The Company’s restructuring actions have resulted in shortened estimated useful lives of certain

machinery and equipment and buildings and subsequent disposal of machinery and equipment no

longer in use. Refer to Note 5 to the Consolidated Financial Statements for a discussion of these

actions and the impact on earnings.

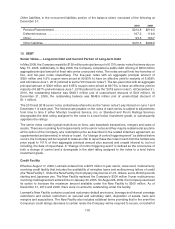

Long-lived assets held for sale

Related to the April 2009 restructuring plan, the Company’s inkjet cartridge manufacturing facility in

Juarez, Mexico qualified as held for sale in the first quarter of 2010. The asset is included in Property, plant

and equipment, net on the Consolidated Statements of Financial Position at December 31, 2010 at the

lower of its carrying amount or fair value less costs to sell in accordance with guidance on accounting for

the impairment or disposal of long-lived assets. The carrying value of the building and land held for sale

was approximately $3 million at December 31, 2010. It is estimated that the fair value of the site is in the

range of $3 million to $4 million based on an average of the fair values calculated under the income

approach and market approach. The income approach was based on a hypothetical leasing arrangement

which considered regional rental market price per square foot and customary lease term assumptions. The

market approach was based on adjusted prices for sales of realty considered comparable to the site. There

were no fair value adjustments recorded in 2010 related to the site held for sale.

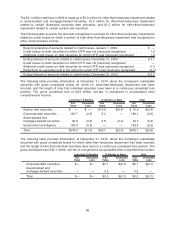

Related to the 2007 restructuring plan, the Company’s Orleans, France facility qualified as held for sale in

the second quarter of 2009. The asset is included in Property, plant and equipment, net on the

Consolidated Statements of Financial Position at the lower of its carrying amount or fair value less

costs to sell in accordance with guidance on accounting for the impairment or disposal of long-lived assets.

The carrying value of the building and land held for sale was approximately $7 million at December 31,

2010. The fair value of the site is estimated to be in the range of $7 million to $8 million based on non-

binding price quotes from a market participant and considering the highest and best use of the asset for

sale. A letter of commitment was signed in the first quarter of 2010 obligating the potential buyer to 10% of

the $7 million sale price. The Company believes it will complete the sale of the facility in 2011. There were

no fair value adjustments recorded in 2010 related to the site held for sale.

Related to the 2008 restructuring plan, the Company received in the second quarter of 2010 final payment

for the sale of its inkjet supplies manufacturing facility in Chihuahua, Mexico in accordance with the sale

agreement signed in the fourth quarter of 2009. Proceeds from the sale were $5.6 million, which resulted in

a $0.5 million realized gain recorded in Selling, general and administrative expense upon derecognition of

the asset group.

99