Lexmark 2010 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2010 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

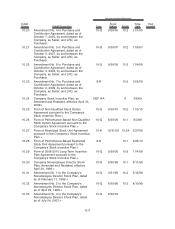

Exhibit

Number Exhibit Description Form

Period

Ending Exhibit

Filing

Date

Filed

Herewith

Incorporated by Reference

10.6 Credit Agreement, dated as of August 17,

2009, by and among the Company, as

Borrower, the Lenders party thereto,

JPMorgan Chase Bank, N.A., as

Administrative Agent, Bank of America,

N.A., as Syndication Agent, and Citibank,

N.A. and SunTrust Bank, as Co-

Documentation Agents.

8-K 10.1 8/21/09

10.7 Amendment to Schedule 2.01 of Credit

Agreement, effective as of August 26,

2009.

8-K/A 10.2 8/28/09

10.8 Amended and Restated Receivables

Purchase Agreement, dated as of October

8, 2004, by and among Lexmark

Receivables Corporation (“LRC”), as

Seller; CIESCO, LLC (“CIESCO”) and

Gotham Funding Corporation (“Gotham”),

as the Investors; Citibank, N.A. (“Citibank”)

and The Bank of Tokyo-Mitsubishi, Ltd.,

New York Branch (“BTM”), as the Banks;

Citicorp North America, Inc. (“CNAI”) and

BTM, as the Investor Agents; CNAI, as

Program Agent for the Investors and

Banks; and the Company, as Collection

Agent and Originator.

8-K 10.1 10/13/04

10.9 Amendment No. 1 to Receivables

Purchase Agreement, dated as of October

7, 2005, by and among LRC, as Seller;

CIESCO and Gotham, as the Investors;

Citibank and BTM, as the Banks; CNAI, as

Program Agent; CNAI and BTM, as the

Investor Agents; and the Company, as

Collection Agent and Originator.

10-Q 9/30/05 10.1 11/1/05

10.10 Amendment No. 2 to Receivables

Purchase Agreement, dated as of October

6, 2006, by and among LRC, as Seller;

CIESCO and Gotham, as the Investors;

Citibank and The Bank of Tokyo-Mitsubishi

UFJ, Ltd., New York Branch (“BTMUFJ”),

as the Banks; CNAI, as Program Agent;

CNAI and BTMUFJ, as Investor Agents;

and the Company, as Collection Agent and

Originator.

10-Q 9/30/06 10.1 11/7/06

10.11 Amendment No. 3 to Receivables

Purchase Agreement, dated as of March

30, 2007, by and among LRC, as Seller;

CIESCO and Gotham, as the Investors;

Citibank and BTMUFJ, as the Banks;

CNAI, as Program Agent; CNAI and

BTMUFJ, as Investor Agents, and the

Company, as Collection Agent and

Originator.

10-Q 3/31/07 10.2 5/8/07

E-2