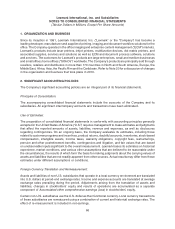

Lexmark 2010 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2010 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The New Facility also includes collateral terms providing that in the event the Company’s credit ratings

decrease to certain levels (Moody’s Ba2 or lower, S&P BB or lower) the Company will be required to secure

on behalf of the lenders first priority security interests in the Company’s owned U.S. assets. These

collateral arrangements will be released upon the Company achieving certain improvements in its credit

ratings (Moody’s Baa3 or higher, S&P BBB- or higher).

Interest on all borrowings under the New Facility depends upon the type of loan, namely alternative base

rate borrowings, swingline loans or eurocurrency borrowings. Alternative base rate borrowings bear

interest at the greater of the prime rate, the federal funds rate plus one-half of one percent, or the Adjusted

LIBO Rate (as defined in the New Facility) plus one percent. Swingline loans (limited to $50 million) bear

interest at an agreed upon rate at the time of the borrowing. Eurocurrency loans bear interest at the sum of

(i) LIBOR for the applicable currency and interest period and (ii) the credit default swap spread as defined

in the New Facility subject to a floor of 2.5% and a cap of 4.5%. In addition, Lexmark is required to pay a

commitment fee on the unused portion of the New Facility of 0.40% to 0.75% based upon the Company’s

debt ratings. The interest and commitment fees are payable at least quarterly.

As of December 31, 2010 and 2009, there were no amounts outstanding under the credit facilities.

Additional information related to the New Facility can be found in the Form 8-K and Form 8-K/A reports that

were filed with the SEC by the Company on August 21, 2009 and August 28, 2009, respectively.

Credit Ratings and Other Information

The Company’s credit rating was downgraded by Standard & Poor’s Ratings Services during the first

quarter of 2009 from BBB to BBB-. On April 28, 2009, Moody’s Investors Services downgraded the

Company’s current credit rating from Baa2 to Baa3. Because the ratings remain investment grade, there

were no material changes to the borrowing capacity or cost of borrowing under the facilities that existed at

that time, nor were there any adverse changes to the coupon payments on the Company’s public debt. The

Company does not have any rating downgrade triggers that accelerate the maturity dates of its revolving

credit facility or public debt.

The Company’s credit rating can be influenced by a number of factors, including overall economic

conditions, demand for the Company’s products and services and ability to generate sufficient cash

flow to service the Company’s debt. A downgrade in the Company’s credit rating to non-investment grade

would decrease the maximum availability under its trade receivables facility, increase the cost of borrowing

under the revolving credit facility and the coupon payments on the Company’s public debt, potentially

trigger collateral requirements under the new revolving credit facility described above, and likely have an

adverse effect on the Company’s ability to obtain access to new financings in the future.

The Company was in compliance with all covenants and other requirements set forth in its debt

agreements at December 31, 2010.

Off-Balance Sheet Arrangements

At December 31, 2010 and 2009, the Company did not have any off-balance sheet arrangements.

58