Lexmark 2010 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2010 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

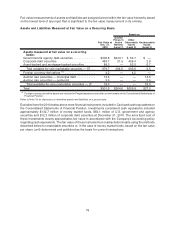

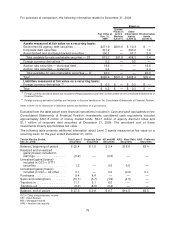

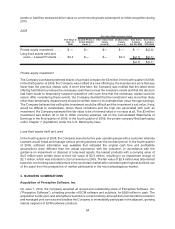

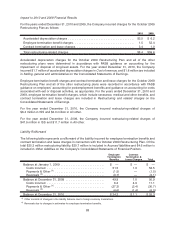

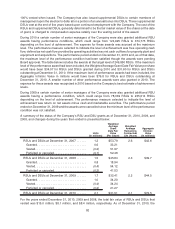

assets or liabilities measured at fair value on a nonrecurring basis subsequent to initial recognition during

2010.

2009

Fair Value at

Dec. 31,

2009

Quoted Prices in

Active Markets

(Level 1)

Other Observable

Inputs

(Level 2)

Unobservable

Inputs

(Level 3)

Total Gains

(Losses)

4th Qtr 2009

Total Gains

(Losses)

YTD 2009

Fair Value Measurements Using

Private equity investment. . . . . $ — $— $— $ — $ — $(3.0)

Long-lived assets held and

used — Leased Products . . . $2.4 $— $— $2.4 $(2.1) $(2.1)

$(2.1) $(5.1)

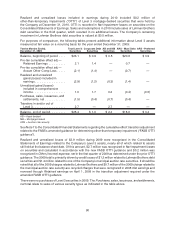

Private equity investment

The Company purchased preferred shares of a private company for $3 million in the fourth quarter of 2008.

In the third quarter of 2009, the Company was notified of a new offering by the investee at a price that was

lower than the previous shares sold. A short time later, the Company was notified that the latest stock

offering had failed to produce the necessary cash flow to meet the investee’s needs and that the decision

had been made to temporarily suspend operations until such time that the necessary capital could be

raised. After considering these events, the Company decided that the investment was more than likely

other-than-temporarily impaired and should be written down to its estimated fair value through earnings.

The Company believes that selling this investment would be difficult and the investment’s exit value, if any,

would be difficult to substantiate. Given these conditions and the high risk associated with such an

investment, the Company estimated the fair value to be of minimal value or no value at all. The $3 million

investment was written off in full to Other (income) expense, net on the Consolidated Statements of

Earnings in the third quarter of 2009. In the fourth quarter of 2009, the private company filed bankruptcy

under Chapter 7 (liquidation) under the U.S. Bankruptcy laws.

Long-lived assets held and used

In the fourth quarter of 2008, the Company executed a five year operating lease with a customer whereby

Lexmark would install and manage various printing devices over the contract period. In the fourth quarter

of 2009, sufficient information was available that indicated the original cash flow and profitability

assumptions were different than the actual experience with the customer. In accordance with the

guidance on impairment or disposal of long-lived assets, the leased products with a carrying value of

$4.5 million were written down to their fair value of $2.4 million, resulting in an impairment charge of

$2.1 million, which was included in Cost of revenue in 2009. The fair value of $2.4 million was determined

based on non-binding used retail prices in the secondary market after considering the highest and best use

of the asset from the perspective of market participants in the most advantageous market.

4. BUSINESS COMBINATIONS

Acquisition of Perceptive Software, Inc.

On June 7, 2010, the Company acquired all issued and outstanding stock of Perceptive Software, Inc.

(“Perceptive Software”), a leading provider of ECM software and solutions, for $280 million in cash. The

acquisition builds upon and strengthens Lexmark’s current industry-focused document workflow solutions

and managed print services and enables the Company to immediately participate in the adjacent, growing

market segment of ECM software solutions.

84