Lexmark 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Lexmark International, Inc. and Subsidiaries

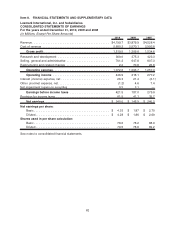

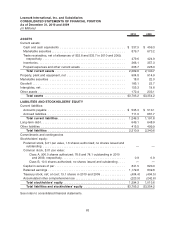

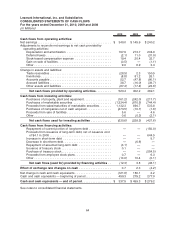

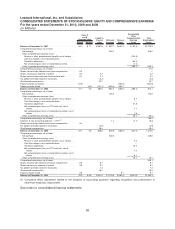

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular Dollars in Millions, Except Per Share Amounts)

1. ORGANIZATION AND BUSINESS

Since its inception in 1991, Lexmark International, Inc. (“Lexmark” or the “Company”) has become a

leading developer, manufacturer and supplier of printing, imaging and document workflow solutions for the

office. The Company operates in the office imaging and enterprise content management (“ECM”) markets.

Lexmark’s products include laser printers, inkjet printers, multifunction devices, dot matrix printers, and

associated supplies, services and solutions as well as ECM and document process software, solutions

and services. The customers for Lexmark’s products are large enterprises, small and medium businesses

and small offices home offices (“SOHOs”) worldwide. The Company’s products are principally sold through

resellers, retailers and distributors in more than 170 countries in North and South America, Europe, the

Middle East, Africa, Asia, the Pacific Rim and the Caribbean. Refer to Note 20 for a discussion of changes

in the organization and business that took place in 2010.

2. SIGNIFICANT ACCOUNTING POLICIES

The Company’s significant accounting policies are an integral part of its financial statements.

Principles of Consolidation:

The accompanying consolidated financial statements include the accounts of the Company and its

subsidiaries. All significant intercompany accounts and transactions have been eliminated.

Use of Estimates:

The preparation of consolidated financial statements in conformity with accounting principles generally

accepted in the United States of America (“U.S.”) requires management to make estimates and judgments

that affect the reported amounts of assets, liabilities, revenue and expenses, as well as disclosures

regarding contingencies. On an ongoing basis, the Company evaluates its estimates, including those

related to customer programs and incentives, product returns, doubtful accounts, inventories, stock-based

compensation, intangible assets, income taxes, warranty obligations, copyright fees, restructurings,

pension and other postretirement benefits, contingencies and litigation, and fair values that are based

on unobservable inputs significant to the overall measurement. Lexmark bases its estimates on historical

experience, market conditions, and various other assumptions that are believed to be reasonable under

the circumstances, the results of which form the basis for making judgments about the carrying values of

assets and liabilities that are not readily apparent from other sources. Actual results may differ from these

estimates under different assumptions or conditions.

Foreign Currency Translation and Remeasurement:

Assets and liabilities of non-U.S. subsidiaries that operate in a local currency environment are translated

into U.S. dollars at period-end exchange rates. Income and expense accounts are translated at average

exchange rates prevailing during the period. Adjustments arising from the translation of assets and

liabilities, changes in stockholders’ equity and results of operations are accumulated as a separate

component of Accumulated other comprehensive earnings (loss) in stockholders’ equity.

Certain non-U.S. subsidiaries use the U.S. dollar as their functional currency. Local currency transactions

of these subsidiaries are remeasured using a combination of current and historical exchange rates. The

effect of re-measurement is included in net earnings.

66